By Andrew Rapacke, Managing Partner & Registered Patent Attorney. For information on cryptocurrency patent examples from top companies, see our recent article.

Baidu holds approximately 15,600 AI patent families: more than any company on Earth. Yet their patents average just 1.9 forward citations each, while U.S. patents in the same field average 13.2 citations. This 7x gap reveals a critical truth: the race for AI dominance isn’t about who files the most patents. It’s about who controls the foundational technologies that everyone else must build around. This concentration has implications for licensing strategies and cross-licensing negotiations that tech startups must navigate when entering AI markets.

According to 2024 PatentSight data, Chinese companies now hold four of the top five positions by patent volume, led by Baidu and Tencent with roughly 15,600 and 14,500 patent families, respectively. But only 7% of these Chinese patents extend beyond China’s borders, while U.S. companies routinely file 50% or more of their patents internationally. Research from R&D World confirms that American AI patents receive dramatically higher citation rates, indicating they’re driving follow-on innovation in ways that pure volume cannot capture.

Whether you’re a SaaS founder evaluating acquisition targets, a solo inventor assessing competitive threats, or building your own AI IP strategy, understanding this quality-versus-quantity divide matters more than tracking raw patent counts.

A note on terminology: Throughout this article, we refer to “AI patents” for clarity and readability. However, it’s essential to understand that there are only three types of patents under U.S. law: utility, design, and plant. What we call “AI patents” are actually utility patents directed toward artificial intelligence technology. This is true for any technology-specific patent category you might encounter—software patents, biotech patents, or blockchain patents are all utility patents focused on those particular technologies.

This analysis breaks down exactly who holds the most valuable utility patents in the AI space, which technologies are seeing explosive filing growth, and what these patterns mean for the future of AI competition, especially for tech startups navigating the patent landscape.

Quick Answer: What Company Has the Most AI Patents Right Now?

Based on comprehensive 2023-2024 data from LexisNexis PatentSight and WIPO patent landscape reports, Baidu currently leads global rankings with approximately 15,600 active AI patent families. Tencent follows at 14,500 families, with both Chinese giants significantly outpacing any U.S. competitor by raw count.

These rankings use “patent families” rather than individual filings: a critical distinction for understanding accurate innovation output. A single breakthrough invention might generate separate patent applications in the U.S., Europe, China, Japan, and Korea. Counting each filing individually would inflate numbers by 3-5x and obscure actual innovation output. Patent families group all related filings for the same invention, providing an accurate count of unique innovations regardless of the number of jurisdictions in which they’re filed.

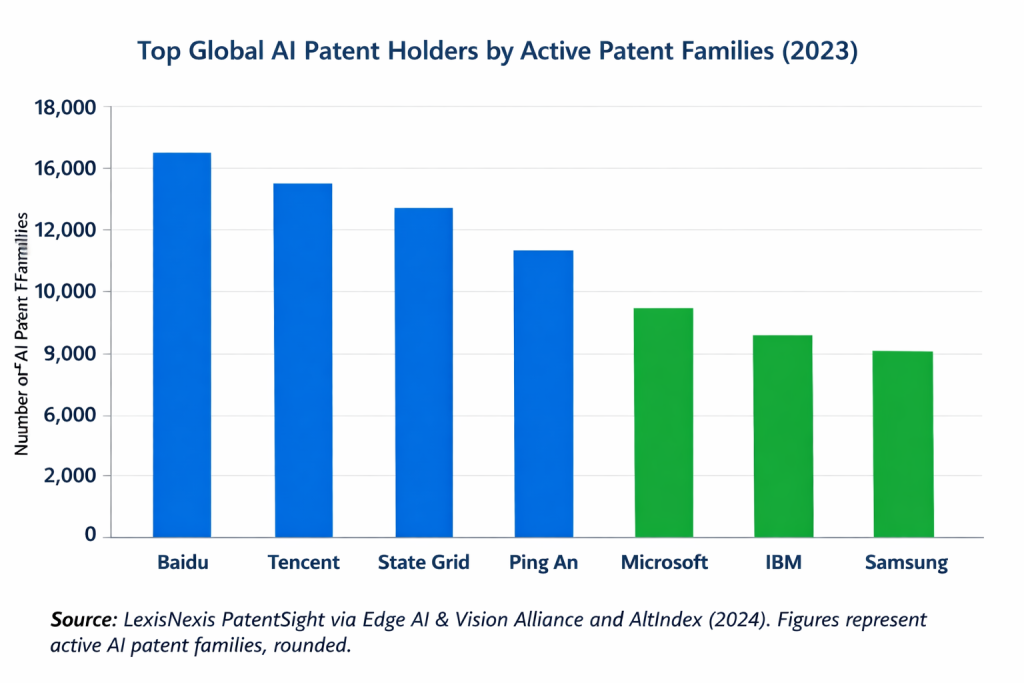

Here’s how the top patent holders stack up by active AI patent families (2023 data):

- Baidu (China): ~15,600 AI patent families

- Tencent (China): ~14,500 families

- State Grid (China): ~13,500 families

- Ping An (China): ~10,500 families

- Microsoft (USA): ~5,800 to 6,400 families

- IBM (USA): ~6,000+ families (estimated)

- Samsung (S. Korea): ~6,000+ families (estimated)

- Alphabet/Google (USA): ~4,000+ families

Figure 1: Top Global AI Patent Holders by Active Patent Families (2023): This chart compares leading companies by the number of active AI patent families worldwide, highlighting the scale advantage of Chinese organizations such as Baidu, Tencent, State Grid, and Ping An. While U.S. and Korean firms like Microsoft, IBM, and Samsung hold smaller portfolios by volume, their patents are typically filed across more jurisdictions and emphasize foundational technologies. The visualization underscores the divide between volume-driven domestic patent strategies and globally oriented, high-enforceability portfolios.

Chinese companies dominate the top four positions by sheer volume. Yet this tells only part of the story. According to Patent Result analysis, U.S. AI patents average 13.18 forward citations, compared to 1.90 for Chinese patents: a 7x difference that indicates American inventions spawn far more follow-on innovation. Additionally, over 40% of U.S. generative AI patent families have international filings, compared with only 7% for Chinese patents, which dramatically affects real-world enforceability. U.S. utility patents directed toward AI are often considered more valuable due to their broader international coverage and higher perceived value in the global market.

The takeaway for AI innovators: The volume leader and the innovation leader are not the same company, a pattern that shapes competitive dynamics across the entire AI landscape. If you’re developing AI technology, understanding where to file and what claims to pursue matters far more than simply accumulating patent counts.

How AI Patents Are Counted (And Why Numbers Differ)

Different patent reports can rank the same company anywhere from #2 to #8, depending on the methodology. Understanding why these numbers diverge matters when evaluating portfolio strength or tracking competitive intelligence.

Patent Families vs. Raw Applications

The most critical distinction: patent families versus raw filing counts. A company developing a breakthrough neural network architecture might file patents in 10+ jurisdictions, including the U.S., the European Patent Office, China, Japan, Korea, Canada, Australia, India, and others.

Count each filing individually, and that single invention appears as 10 patents. Use patent family methodology, and it counts as one unique innovation across multiple territories. Research-grade analyses consistently use family counts to avoid this distortion. Raw application counts can make portfolios appear 3-5x larger than their actual innovation output.

For AI startups: When evaluating your own patent strategy or assessing competitors, always ask whether you’re looking at patent families or raw filings. This distinction determines whether you’re comparing 50 genuine innovations or just 10 innovations filed in five countries each.

Classification Systems Vary Widely

No universal definition exists for what constitutes an “AI patent.” WIPO, OECD, PatentSight, IFI Claims, and other patent analytics firms each use different keyword sets and technology classifications. One analysis might include AI-driven recommendation algorithms, while another excludes them entirely, shifting company rankings by several positions.

Generative AI represents an especially complex boundary case. Some analyses now break out GenAI as a separate category with its own metrics, while others roll it into broader machine learning classifications. As the USPTO noted in 2024, AI-related innovations now appear in 60% of all patent technology subclasses, underscoring how AI has diffused across traditional boundaries and making clean categorization increasingly difficult.

Time Lag Effects

Patent publication follows an 18-month delay from filing. This creates a persistent lag in which the most recent 12-18 months of innovation activity remain invisible in patent databases. Rankings claiming to show “2024 leaders” often rely on data through 2022 or early 2023, with projections based on filing velocity to estimate current standings.

For emerging technology categories such as generative AI, this is particularly significant. WIPO’s 2024 GenAI patent report notes that over 25% of all generative AI patents were published in 2023 alone, indicating that current filing rates have accelerated dramatically beyond what the published data reflects.

Strategic timing consideration: If you’re developing AI technology, this 18-month lag works both ways. Your competitors can’t see what you filed yesterday, but you also don’t know what they filed in the last year and a half. Comprehensive prior art searches become essential before committing to development paths.

Active vs. Historical Portfolios

Some rankings count only patents currently in force. Others include expired, lapsed, or abandoned patents in historical tallies. This distinction particularly affects companies with decades-old portfolios, like IBM, which holds thousands of foundational AI patents from the 1990s and 2000s: some are still active, many have expired.

Companies focusing on “active patent families in force” provide the most accurate picture of current competitive positioning, though historical patents can still influence licensing negotiations and cross-license agreements.

Geographic Coverage Multipliers

A company filing 10,000 patents exclusively in China shows massive volume but limited global leverage. Another company that has filed 3,000 patents across the U.S., European, Japanese, Korean, and Chinese patent offices controls enforceable rights in every significant market.

According to research from Parola Analytics, approximately 7-10% of Chinese AI patents extend to international jurisdictions through PCT (Patent Cooperation Treaty) or direct foreign filings. In contrast, U.S. and European companies typically file 50% or more of their strategic patents internationally. The difference in enforcement leverage is substantial; patents only protect in jurisdictions where they’re granted.

When evaluating patent portfolios, always verify: What methodology was used? What timeframe does the data cover? Does it count families or raw filings? Are these active patents with international coverage, or primarily domestic filings?

Global Leaders By AI Patent Volume

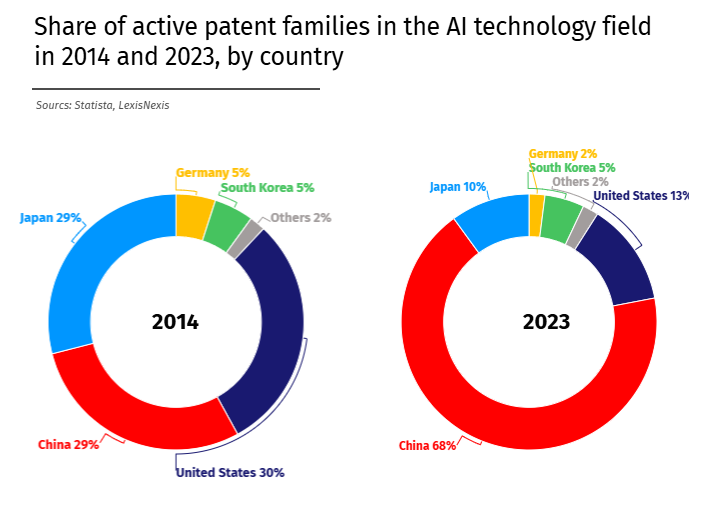

China’s dominance in AI patent volume didn’t emerge gradually; it exploded. The country now accounts for roughly 60-70% of global AI patent filings, up from just 29% in 2014. By 2023, China’s share of active AI patent families worldwide reached approximately 68%, while the U.S. share fell from 26% to around 13% in that same period. Government initiatives have actively encouraged and supported AI patent filings, further shaping the global AI patent landscape.

Tencent: Ecosystem Strategy Through Patent Volume

With approximately 14,500 AI patent families, Tencent represents China’s systematic approach to AI intellectual property. Analysis of Tencent’s patent portfolio shows heavy concentration across their business ecosystem: content recommendation systems for WeChat and QQ, gaming AI for NPC behaviors and matchmaking, fintech algorithms for fraud detection and credit scoring, and increasingly, generative AI for content creation.

Between 2014 and 2023, Tencent accumulated over 2,000 patent families focused on generative AI, including large language models, image generators, and AI-driven content tools. Their filing pace accelerated dramatically after 2022, coinciding with the integration of GenAI capabilities into WeChat, gaming platforms, and cloud offerings. However, most Tencent patents remain filed exclusively in China, with only select innovations receiving U.S. or European patent protection.

Baidu: Search and Autonomous Driving IP

Baidu edges ahead with approximately 15,600 AI patent families, reflecting its dual focus on search technology and autonomous vehicles. As China’s dominant search engine, Baidu’s patents focus on search ranking algorithms, voice recognition, natural language processing for Chinese, knowledge graphs, and conversational AI.

By 2023, Baidu had filed more than 1,200 generative AI patents specifically, supporting its ERNIE large language model and related conversational AI products. The company’s Apollo autonomous driving platform has generated substantial patents in computer vision, LiDAR processing, sensor fusion, and driving decision algorithms. Like Tencent, Baidu files primarily in China with selective foreign protection for technologies entering international markets.

IBM: Decades of Strategic AI Patent Building

IBM maintains over 6,000 AI patent families but approaches patent strategy differently than volume-focused Chinese competitors. IBM, which stands for International Business Machines, is a major player with an extensive AI patent portfolio across technology, hardware, and industry-specific applications. The company’s portfolio spans fundamental machine learning algorithms, natural language processing systems (Watson-related inventions), neuromorphic computing, and sector-specific applications in finance, healthcare, and logistics.

In 2023, IBM obtained more U.S. AI patents than any other company: over 300 more than the next competitor. This reflects IBM’s continued innovation across areas such as its Watsonx platform, AI model training techniques, and hybrid cloud AI architectures. IBM’s utility patents covering core AI methods have generated hundreds of millions in licensing revenue over the years, demonstrating that strategic patent positioning can create multiple revenue streams beyond direct product sales.

Samsung: Hardware-Software Integration Excellence

Samsung holds approximately 6,000-7,000 AI patent families concentrated in consumer devices, image processing, on-device AI, and AI accelerator chips. Their focus on hardware-software integration gives them strong positioning in mobile AI, edge computing, and IoT applications where AI processing happens on-device rather than in the cloud.

Notably, a 2023 Patent Asset Index ranked Samsung’s AI patent portfolio as the world’s most technically influential, despite Samsung not holding the largest number of patents. This quality metric analyzes citation patterns and technological impact, suggesting that Samsung’s patents cover key innovations that other companies frequently build upon or reference in their own patent filings.

Ping An: Insurance Industry’s AI Transformation

Ping An represents the most dramatic rise in AI patenting. Around 2015, the Chinese insurance and fintech conglomerate held fewer than 50 AI patent families. By 2023, it had exploded to over 10,500 families, vaulting into the global top five.

This surge was propelled by Ping An’s push into AI-driven insurance risk modeling, facial recognition for security verification, health diagnostics (through its Good Doctor platform), and financial fraud detection. Ping An’s patents cover medical image analysis algorithms comparable to those of major technology companies, demonstrating that China’s AI boom has extended beyond traditional tech sectors into finance, healthcare, and insurance.

Microsoft and Google: Strategic International Coverage

Microsoft (approximately 5,800 to 6,400 families) and Alphabet/Google (4,000+ families) maintain smaller portfolios by count but place greater emphasis on international patent coverage than Chinese competitors. Both file across U.S., European, Chinese, Japanese, and Korean patent offices for key AI inventions, ensuring global enforceability.

Microsoft’s recent patents concentrate on large language models (particularly Azure OpenAI Service-related technologies), enterprise AI applications, and responsible AI tools addressing bias detection and model explainability. Google’s portfolio heavily emphasizes foundational AI research, including Tensor Processing Units (TPUs), Transformer model architectures, BERT implementations, and DeepMind’s reinforcement learning innovations.

The distinction: while raw patent counts favor Chinese companies, American tech leaders ensure their most valuable inventions receive protection across the primary markets, dramatically increasing enforcement leverage and licensing potential.

Quality vs Quantity: Who Has The Most Valuable AI Patents?

Patent quality research consistently shows that less than 1% of patents generate the majority of economic value through licensing revenue, blocking competitors, or creating true competitive moats. In AI, this quality gap between volume leaders and influence leaders has become especially pronounced. A few companies holding the most valuable AI utility patents can achieve market-crushing outperformance and secure dominant market positions through strategic portfolio development.

Citation Impact: The 7x Quality Gap

According to 2024 research from R&D World analyzing Patent Result data, U.S.-originated AI patents receive an average of 13.18 forward citations each, compared to just 1.90 citations for Chinese AI patents. This nearly 7x difference indicates that American inventions spawn substantially more follow-on innovation: a key marker of foundational versus incremental patents.

Forward citations (how often later patents reference an earlier patent) serve as a proxy for technological influence. Highly cited patents typically cover breakthrough concepts that downstream innovators must either license, design around, or build upon. Low citation rates suggest narrow, application-specific patents that others can easily work around or simply ignore.

The citation gap extends beyond the U.S.-China divide. German AI patents average 6.1 citations, Japanese patents 6.3, and South Korean patents 3.1, all substantially higher than China’s 1.9 but lower than the U.S. benchmark.

For AI developers: If you’re filing patents on your AI technology, aim for broad, foundational claims that will force competitors to either license from you or invest heavily in alternative approaches. Narrow application claims may be easier to obtain but provide minimal competitive protection. Learn more about crafting strong AI patent claims in our AI Patent Mastery guide.

Global Enforceability: Coverage Determines Value

Many Chinese firms file the bulk of their patents exclusively through China’s National Intellectual Property Administration (CNIPA). These domestic patents contribute to volume statistics but provide limited leverage abroad. Only about 7% of Chinese GenAI patent families have been filed internationally, versus over 40% for U.S. GenAI families.

American, European, Japanese, and Korean companies routinely file their important AI inventions in 10+ jurisdictions. Patents with transnational footprints prove more valuable; they enable companies to enforce rights across major markets, negotiate stronger cross-license deals, and generate international licensing revenue.

For example, companies like Huawei and Tencent file AI patents across multiple jurisdictions. Still, entities such as State Grid Corporation and Industrial and Commercial Bank of China (ICBC) often file only domestically. The result: State Grid’s 13,500 patent families create barriers in China’s energy sector but provide minimal IP leverage in Europe or North America.

Foundational vs. Application Patents

The most valuable patents cover broad, foundational technologies that underpin entire product categories. In AI, foundational patents might include:

- Transformer neural network architectures: Google’s patents stemming from the breakthrough 2017 “Attention Is All You Need” paper underpin virtually all modern generative AI, from GPT to Gemini to Claude.

- Core training methods: Fundamental techniques for backpropagation, gradient descent optimization, or distributed training that all AI practitioners need.

- Novel model architectures: Convolutional neural networks, generative adversarial networks (GANs), diffusion models; new paradigms that enable entire application categories.

Foundational utility patents covering core enabling technologies create the most substantial competitive barriers and licensing leverage, as they underpin entire product categories that competitors must navigate.

In contrast, application-specific patents cover narrow use cases: “Method for optimizing insurance claim processing using machine learning” or “AI-driven recommendation system for e-commerce product placement.” These might be important to one company’s competitive advantage, but they are easier for competitors to design around.

A single foundational patent can create more licensing leverage than thousands of narrow application filings. This explains why investors and analysts increasingly focus on patent quality metrics, such as citation impact, claim breadth, and international coverage, when evaluating AI companies, not just raw counts.

Real-World Quality Examples

Google’s Transformer patents: Filed after the breakthrough 2017 paper, these patents covering self-attention mechanisms and model architectures are among the most highly cited AI patents globally. Every company building large language models must navigate this IP.

IBM’s Watson-related NLP patents: IBM’s early patents on question-answering systems and natural language understanding (stemming from Watson’s 2011 Jeopardy! victory) are frequently cited in subsequent NLP filings. These foundational patents have generated licensing revenue for over a decade.

NVIDIA’s GPU training patents: Patents covering methods for efficiently training neural networks on distributed GPUs underpin how large models are trained at scale. With AI model sizes exploding, these hardware-level patents give NVIDIA tremendous leverage.

Microsoft’s cloud AI infrastructure patents: Patents addressing AI deployment at scale, model serving, and enterprise AI management create defensive moats around Azure’s competitive positioning.

Research showing that only 7% of Chinese GenAI patent families have international filings, compared with 40%+ for U.S. families, demonstrates how geographic strategy amplifies quality advantages. American companies control globally enforceable rights over foundational technologies, while Chinese volume leaders primarily rely on domestic protection: a critical distinction as AI markets globalize.

American Tech Leaders: Strategic AI Patent Portfolios

U.S. companies approach AI patents with a quality-first mindset: file foundational innovations broadly across major jurisdictions, ensure claims cover core enabling technologies, and maintain portfolios that create multiple revenue streams through licensing, cross-licensing leverage, and competitive barriers.

This breadth of utility patents directed toward AI-related innovations establishes their leadership and defensive positions in the industry.

Alphabet/Google: Foundational Research Dominance

Google’s approximately 4,000 AI patent families focus heavily on commercializing foundational research. The company invested early in deep learning and secured patents on core technologies that now define modern AI:

Transformer Architecture Patents: Following the revolutionary 2017 “Attention Is All You Need” paper, Google filed patents covering self-attention mechanisms, positional encoding methods, and transformer model structures. These patents are among the most highly cited AI filings globally, as virtually every advanced language model from GPT to Claude builds on transformer concepts.

Tensor Processing Unit (TPU) Patents: Google’s custom AI accelerator chips and the architectures that enable efficient neural network training at scale create hardware-level advantages that competitors must license or design around.

DeepMind Innovations: Patents stemming from AlphaGo, AlphaZero, and AlphaFold breakthroughs cover neural network optimization techniques, reinforcement learning algorithms, and protein structure prediction methods that influence both AI research and practical applications.

Google typically files its essential AI patents with the U.S., European, Japanese, Korean, and Chinese patent offices, reflecting its global product reach and ensuring maximum enforceability. This international coverage strategy, combined with highly cited foundational technologies, makes Google’s smaller portfolio punch far above its weight in competitive leverage.

Microsoft: Enterprise AI and Responsible AI Leadership

With approximately 5,800-6,400 AI patent families, Microsoft has steadily grown its IP through Microsoft Research output and product development across Azure AI, Office AI features, and GitHub Copilot technologies.

Large Language Model Patents: Microsoft’s investment in OpenAI and the Azure OpenAI Service has driven recent patent activity around language models, prompt engineering techniques, and integration methods for enterprise applications. These patents position Microsoft for the GenAI wave while protecting Azure’s competitive moat.

Responsible AI Patents: Microsoft has filed extensively in emerging areas like AI bias detection, model explainability, fairness constraints, and privacy-preserving AI techniques. As regulators increase scrutiny on AI safety and fairness, these “responsible AI” patents may become strategically vital for enterprises needing compliant deployment.

Cloud Infrastructure Patents: Beyond algorithms, Microsoft holds patents for core cloud infrastructure that enable AI at scale, including distributed training systems, inference optimization, and AI model management platforms, which create operational advantages for Azure.

Microsoft CEO Satya Nadella’s approach emphasizes strategic focus over volume: “We will not be the volume leader in patents, but [we focus on] the ones that matter most for the future of cloud and AI.”

IBM: Breadth Across Eras and Industries

IBM’s 6,000+ AI patent families represent unmatched breadth reflecting decades of R&D investment. IBM obtained more U.S. AI patents in 2023 than any other company: over 300 more than the next competitor, demonstrating continued innovation despite its older portfolio.

Watson-Related NLP Patents: Natural language understanding, question-answering systems, and knowledge representation patents from Watson’s development remain highly cited. These foundational NLP patents influence industry-wide development of conversational AI.

Neuromorphic Computing: IBM holds patents on brain-inspired computing architectures, neuromorphic chip designs, and hybrid algorithms combining quantum and classical computing for AI workloads.

Enterprise AI Patents: Sector-specific innovations in healthcare AI (medical imaging, diagnostics) and financial services (fraud detection, risk modeling) create defensive positioning for IBM’s enterprise software offerings.

IBM’s international filing strategy and extensive cross-licensing agreements with fellow tech giants ensure it can both monetize IP and avoid litigation through “patent peace” arrangements common among major players.

NVIDIA: Hardware Chokepoint Control

NVIDIA holds approximately 5,000 utility patents related to AI concentrated in GPUs, AI accelerators, and high-performance computing systems: less impressive by count but extraordinarily strategic by position. NVIDIA’s patent portfolio covers:

GPU Architectures for AI: Patents on Tensor Cores, GPU memory hierarchies optimized for machine learning, and parallel processing methods for neural network operations give NVIDIA control over the tools most practitioners need for AI development.

CUDA and Software Frameworks: Beyond hardware, NVIDIA has patented software architectures that enable efficient AI development, creating ecosystem lock-in as developers train models using CUDA-optimized libraries.

Autonomous Vehicle and Robotics Systems: The NVIDIA Drive platform and Jetson embedded AI modules have generated patent families covering perception systems, sensor fusion, and real-time inference for edge deployment.

With AI model sizes and computational requirements exploding, NVIDIA’s hardware patents provide tremendous leverage. Any competitor building similar AI compute accelerators must carefully navigate NVIDIA’s IP or face potential litigation.

Amazon: E-Commerce and Cloud AI Integration

Amazon files fewer AI patents than Microsoft or IBM, but focuses on applications that directly support its business model. Key areas include:

Recommendation Systems: Extensive patent portfolios in personalization algorithms, collaborative filtering, and AI-driven product suggestions are vital for e-commerce and Prime content recommendations.

Logistics and Robotics AI: Patents covering warehouse optimization, delivery route planning, inventory management using machine learning, and robotic fulfillment systems that create operational advantages.

AWS AI Services: Cloud-based AI patents on SageMaker features, AI-driven security monitoring, and generative AI tools for content creation support Amazon’s competitive positioning in the cloud infrastructure market.

Like Microsoft and Google, Amazon files essential patents across major global jurisdictions, ensuring international enforceability as AWS expands globally and Amazon Retail operates in multiple markets.

Strategic Filing Pattern: Global Coverage First

The common thread among American tech leaders: global patent coverage for significant innovations. Filing in the U.S., European Patent Office, China, Japan, Korea, Canada, and other jurisdictions increases upfront costs but creates:

- Stronger enforcement options: Sue infringers or demand licensing fees in multiple markets simultaneously.

- Higher licensing leverage: Companies need rights in all major markets, increasing willingness to pay for licenses.

- Cross-licensing power: Broader portfolios create a better bargaining position in patent pools and mutual licensing agreements.

For SaaS founders and tech startups: Patent value depends as much on where you file as what you patent. Strategic international coverage beats domestic-only volume. If you’re developing AI technology for global markets, consider filing a PCT application to preserve international options. Our SaaS Patent Guide 2.0 explains international filing strategies and cost management for startups.

Chinese Technology Giants: Dominating AI Patent Volume

China’s AI patent surge stems from deliberate policy: government incentives explicitly reward patent filings, research institutes face patent quotas, and companies use patent counts as success metrics. Government initiatives have played a key role in driving this surge, with national policies and strategic programs actively encouraging and supporting AI patent filings. Since the 2015 “New Generation AI Development Plan,” patent activity has exploded, creating what some analysts call a “patent bubble” where volume sometimes outpaces commercial value.

Tencent: Social, Gaming, and GenAI Integration

Tencent’s 14,500+ AI patent families reflect an ecosystem approach spanning all business units. Between 2014 and 2023, Tencent filed over 2,000 patent families in generative AI, including large language models, image generators, video synthesis, and AI-driven content creation tools.

Social Media AI: WeChat and QQ feature patents covering recommendation algorithms, content moderation using computer vision and NLP, user engagement prediction, and conversational AI features.

Gaming AI: NPC behavior systems, procedural content generation, matchmaking algorithms, anti-cheat detection, and player retention prediction across Tencent’s gaming portfolio.

Fintech Applications: Fraud detection systems, credit scoring models, payment security, and risk assessment for WeChat Pay and associated financial services.

The burst of GenAI filings after 2022 coincides with the integration of generative capabilities into WeChat, gaming platforms, and Tencent Cloud offerings. However, most Tencent patents are filed exclusively in China; only select innovations receive U.S. or European protection, limiting the potential for global enforcement despite the company’s massive domestic volume.

Baidu: Search, Autonomous Driving, and Conversational AI

Baidu’s 15,600 patent families tie to its core competencies as China’s dominant search engine and AI services provider. Early investment in AI research (Baidu established its Deep Learning Lab in 2013) shows in patent breadth:

Search and NLP: Search ranking algorithms, query understanding, voice recognition (for Baidu’s speech services), and knowledge graph construction for Chinese language processing.

ERNIE and Generative AI: By 2023, Baidu had filed 1,200+ generative AI patents, specifically supporting its ERNIE large language model family and conversational AI products, competing with ChatGPT-style interfaces.

Apollo Autonomous Driving: Computer vision for object detection, LiDAR processing, sensor fusion algorithms, path planning, and driving decision systems for Baidu’s Apollo self-driving platform.

Baidu files primarily in China, with selective foreign patent protection for technologies entering international markets, and exceptionally autonomous vehicle patents in the U.S. and Europe, where those markets remain relevant.

Ping An: Finance and Healthcare AI Transformation

Ping An’s explosion from under 50 AI patent families in 2015 to 10,500+ by 2023 represents the most dramatic rise among major patent holders. This Chinese insurance and financial services giant recognized that AI could revolutionize its industry and invested accordingly:

Insurance and Financial Risk AI: Risk assessment models, policy pricing algorithms, claims fraud detection, and credit scoring for lending decisions.

Facial Recognition and Computer Vision: Customer verification systems, security screening, document analysis for insurance applications.

Healthcare and Medical AI: Diagnostic imaging analysis, medical image processing patents comparable to those from pharmaceutical companies, and health risk prediction through the Good Doctor telemedicine platform.

Ping An’s portfolio demonstrates how China’s AI boom extended beyond pure tech companies into finance, healthcare, and insurance sectors. However, like Tencent and Baidu, most filings remain domestic, providing strong positioning in China’s massive internal market but limited international leverage.

Other Major Chinese Players

Alibaba: The e-commerce and cloud giant holds thousands of utility patents focused on AI innovations, including recommendation engines, cloud AI services (Alibaba Cloud/Aliyun), logistics optimization, and fintech (Ant Group payment and credit systems). Alibaba’s DAMO Academy research arm generates patents in chip design and database AI.

Huawei: Known primarily for telecom, Huawei invested heavily in AI for 5G/6G network optimization, edge computing, and consumer devices. Patents cover computer vision, facial recognition, IoT integration, and smartphone AI chipsets (such as Kirin processors). Huawei files more internationally than most Chinese peers due to its global telecom presence.

SenseTime and Megvii: AI unicorns specializing in computer vision accumulated large portfolios (hundreds of families) in surveillance systems, facial recognition, smart city infrastructure, and autonomous driving perception.

Chinese Academy of Sciences (CAS): This government research institute consistently ranks in the top 5-10 globally for AI patent filings. Its focus on fundamental research yields patents ranging from basic AI algorithms to applied robotics, often in partnership with industry.

Critical Caveat: Domestic vs. Global Reach

The defining characteristic of China’s patent boom: only about 7-10% of Chinese AI patents extend internationally through PCT or direct foreign filings, versus 50%+ for U.S. and European companies. This creates an asymmetry where Chinese companies control China’s domestic market through patent volume but have limited IP leverage abroad.

Within China’s internal market (still massive at 1.4 billion people), these patent portfolios create formidable barriers. Startups in China attempting to implement AI solutions similar to those of Baidu or Tencent quickly encounter patent roadblocks. Chinese companies increasingly cite each other’s patents, indicating a maturing domestic IP ecosystem despite lower absolute citation rates than Western patents.

For global technology leaders, the rise of Chinese patent giants means anyone operating internationally needs to be conscious of overlapping IP. Cross-licensing deals between Chinese and Western firms may increase (similar to smartphone patent pools) to maintain “patent peace” and avoid mutually assured litigation as markets converge.

Most Influential AI Patents: Beyond The Raw Counts

Patent influence extends beyond filing numbers to technological impact: which inventions spawn follow-on innovation, enable new product categories, or force competitors to design around core concepts? Citation analysis and market adoption reveal the most consequential utility patents in the AI space.

Google’s Transformer Architecture Patents

Following Google researchers’ groundbreaking 2017 “Attention Is All You Need” paper, Google filed patents covering the transformer architecture’s core innovations: self-attention mechanisms, positional encoding, and model structures enabling efficient parallel processing of sequential data.

These transformer patents have quickly become among the most highly cited AI filings globally. Virtually every advanced natural language model (OpenAI’s GPT family, Anthropic’s Claude, Meta’s LLaMA, Google’s own Gemini) builds on transformer concepts. Companies commercializing transformer-based models must navigate Google’s IP through licensing, cross-licensing agreements, or careful claim analysis.

The transformer architecture created modern generative AI, making these foundational patents extraordinarily valuable despite representing just a handful of Google’s 4,000+ patent families.

IBM’s Watson and Early NLP Patents

IBM holds seminal AI patents spanning decades. Watson-related patents covering question-answering systems, natural language query processing, and knowledge representation (filed around Watson’s 2011 Jeopardy! victory) remain highly cited in subsequent NLP and chatbot patent applications.

IBM’s earlier patents from the 1990s to 2000s on machine learning methods, speech recognition systems, and conversational interfaces laid the groundwork that others built upon. These patents generate citation chains spanning decades: companies working in NLP, voice assistants, and conversational AI frequently encounter IBM’s foundational work in prior art searches.

IBM’s continued presence in AI innovation means it appears repeatedly in citation analyses, both for foundational historical patents and for recent filings on hybrid cloud AI, quantum-classical algorithms, and enterprise AI deployment.

Waymo’s Autonomous Vehicle Patents

Waymo (a Google/Alphabet subsidiary) pioneered self-driving car technology, starting in 2009 as the Google Self-Driving Car Project. Its patents on LiDAR-based object detection, sensor fusion combining vision and ranging data, and autonomous driving decision-making algorithms are among the most cited in automotive AI.

Automotive OEMs, suppliers, and AV startups entering the autonomous vehicle space must navigate Waymo’s extensive patent portfolio. For example, patents covering methods for detecting and classifying pedestrians, cyclists, and vehicles using combined sensor inputs have been cited dozens of times by later automotive patents, indicating these patents cover techniques competitors must either license or design around.

Tesla’s Vision-Based Autonomy Patents

Tesla’s approach to autonomy relies primarily on camera vision rather than LiDAR, creating a distinct patent cluster. While Tesla famously pledged some patents “open” in 2014 to encourage EV adoption, it continues filing patents on self-driving technology, particularly computer vision for lane keeping, neural network architectures for driving decisions, and integrated vehicle control systems.

Tesla patents are frequently referenced in other automotive AI patent applications as prior art or comparative examples, indicating their influence on the field, even with Tesla’s more open approach to specific IP.

NVIDIA’s GPU Training Patents

Less visible but critically important: NVIDIA holds patents for methods to train neural networks efficiently using distributed GPU systems. With deep learning model sizes exploding from millions to hundreds of billions of parameters, these hardware-level patents on parallel training, memory management, and gradient synchronization across GPU clusters underpin how virtually all large models are trained.

Any organization building advanced AI systems encounters NVIDIA’s patents around GPU-accelerated training and inference, making these filings strategically valuable despite being less “glamorous” than chatbot or autonomous vehicle patents.

Citation Patterns Reveal Influence

AI patents tend to have higher citation rates than average patents, reflecting AI’s rapid pace and cumulative nature, where innovations build directly on prior work. The average U.S. AI patent receives ~13 citations, compared with ~2 for Chinese AI patents, and highly influential patents receive 50+ citations.

For companies assessing patent portfolios, citation analysis reveals which patents are truly foundational. If competitors constantly cite a company’s patents, it signals that the company’s technology defines the state of the art. This creates licensing opportunities, cross-licensing leverage, and strategic barriers competitors must navigate.

The interplay between academic publications and patents amplifies influence. Google’s “Attention Is All You Need” paper has over 100,000 academic citations; its associated transformer patents are likewise heavily cited in patent filings. This academic-to-commercial pipeline, in which cutting-edge research quickly translates into patentable innovations, characterizes AI more than most other technology domains.

Which AI Patent Categories Are Growing Fastest?

Not all AI domains experience the same level of innovation intensity. Examining patent filing trends by sub-field reveals where competition is hottest and where the next wave of IP battles will emerge.

Several emerging categories show explosive growth:

Edge AI and Hardware: AI models are increasingly deployed on personal devices like smartphones and IoT sensors, with optimizations such as model compression and quantization to run efficiently on limited resources, as well as privacy-preserving methods such as federated learning.

Life Sciences and Healthcare: AI is increasingly important for analyzing medical images for diagnostics and treatment, with generative AI applications in drug design, molecular synthesis, and biopharma innovation supporting the creation of novel compounds.

Emerging Fast-Growth Segments: Augmented reality applications enhancing user experiences across industries, and quantum computing integration in AI-driven research and innovation.

1. Generative AI: Explosive Growth

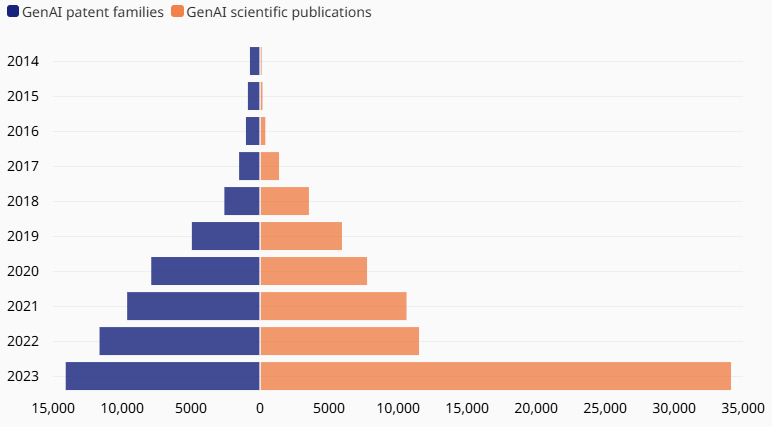

Generative AI represents the fastest-growing patent category in AI history. Over the past decade, GenAI patent families grew from just 733 in 2014 to over 14,000 in 2023: an 800%+ increase. More than 25% of all GenAI patents were published in 2023 alone, indicating an innovation boom following ChatGPT’s public launch.

Figure 2: GenAI Patent Family & Publication Growth (2014–2023): Global innovation in generative AI accelerated sharply after 2017, with patent families rising from 733 in 2014 to more than 14,000 by 2023, alongside an even steeper surge in scientific publications from 116 to approximately 34,000. The parallel growth highlights how breakthroughs such as transformer-based models rapidly translated from academic research into protected commercial intellectual property, making generative AI one of the fastest-expanding patent domains of the past decade. Source: World Intellectual Property Organization (WIPO), Patent Landscape Report – Generative AI, 2024.

According to WIPO’s 2024 GenAI patent report, approximately 54,000 GenAI-related inventions were filed between 2014 and 2023. China leads by volume: Chinese inventors filed 38,210 GenAI patent families in that decade, six times as many as the U.S.’s ~6,276 families. South Korea (4,155), Japan (3,409), and India (1,350) trail significantly.

Which GenAI technologies lead? Large Language Models (LLMs) and Generative Adversarial Networks (GANs) dominate patent filings. GANs alone account for over 9,700 patent families by 2023, followed by variational autoencoders and transformer-based LLMs. Applications range from AI image generation (DALL-E, Midjourney-style systems) to code generation (GitHub Copilot competitors) to video synthesis.

The GenAI patent race is unprecedented: a new technological field’s patent landscape is being carved out in real time. Companies are racing to stake claims before the dust settles, creating both opportunity and risk of patent thickets.

For AI innovators: If you’re developing generative AI technology, the time to file is now. The 800% growth in GenAI patents means prior art searches are becoming more complex, but it also means foundational claims remain available in emerging subcategories. Our AI Patent Mastery guide covers strategies for identifying patentable AI innovations and navigating the GenAI patent landscape.

2. Life Sciences and Healthcare AI: High-Value Convergence

AI in pharmaceutical development and healthcare represents a smaller slice by volume but punches above its weight in strategic value. Approximately 5,346 GenAI patent families (2014-2023) focused on life sciences applications, accounting for about 10% of all GenAI patents.

Drug Discovery AI: Patents covering algorithms for designing new drug molecules, predicting protein-ligand binding, repurposing existing drugs, or accelerating clinical trial recruitment are increasingly common. These innovations can dramatically reduce drug development timelines and costs.

Medical Diagnostics: AI analysis of medical imaging (X-rays, MRIs, CT scans), genomic data interpretation, early-disease detection systems, and personalized medicine recommendations generate high-value patents due to regulatory barriers and their life-or-death impact.

According to IntuitionLabs’ 2025 analysis of pharma AI patents, U.S. entities account for approximately 50% of pharmaceutical AI patent publications since 2020, far outpacing China’s ~17%. This suggests that Western pharmaceutical and biotech companies dominate the quality and real-world application side of healthcare AI, despite China’s overall lead in AI patents.

Medical AI patents face higher quality bars due to regulatory scrutiny (FDA approval requirements, clinical validation), making them valuable long-term IP assets less susceptible to being designed around.

3. Autonomous Vehicles: Continued Heavy Patenting

Self-driving car technology remains an AI patent battleground. Key categories include:

- Perception Systems: Computer vision for object detection, semantic segmentation, LiDAR processing, and radar integration.

- Sensor Fusion: Combining data from cameras, LiDAR, radar, and ultrasonic sensors for robust environmental modeling.

- Path Planning: Trajectory generation, motion prediction for other vehicles/pedestrians, route optimization.

- Vehicle Control: Steering, acceleration, and braking algorithms that safely execute planned maneuvers.

- V2X Communication: Vehicle-to-vehicle and vehicle-to-infrastructure AI for coordinated autonomous driving.

Companies like Waymo, Cruise (GM), Tesla, Baidu (Apollo), Toyota, Hyundai, and numerous startups are filing extensively. Waymo alone holds over 1,000 AV-related patents. Traditional automakers partnering with AI suppliers (Mobileye, Luminar, Velodyne) add thousands more, creating complex patent thickets.

This segment risks becoming litigation-heavy as AVs approach commercial deployment. Multiple players hold overlapping rights on critical technologies, potentially requiring patent pools or extensive cross-licensing to enable industry-wide progress.

4. Emerging Fast-Growth Segments

Several AI application areas are seeing rapid patent growth despite smaller absolute numbers:

Energy Management and Smart Grids: AI for electricity demand prediction, renewable energy integration, load balancing, and grid optimization. State Grid Corporation of China’s emergence as a top-5 AI patent holder (13,500+ families) stems primarily from smart-grid AI patents, demonstrating that industrial applications drive patent activity beyond traditional tech sectors.

Supply Chain and Logistics AI: Route optimization, predictive maintenance for delivery fleets, inventory forecasting, warehouse automation. Companies like UPS, FedEx, Amazon, and logistics startups patent these operational AI systems, accelerated by pandemic-driven focus on supply chain resilience.

Cybersecurity AI: Threat detection using anomaly identification, intrusion prevention systems, malware classification, and insider threat prediction. Both cybersecurity specialists and major tech firms (Microsoft, IBM, Cisco) file patents on AI-driven security monitoring as cyber threats grow more sophisticated.

Agriculture (AgriTech): Precision farming using computer vision for crop health monitoring, yield prediction models, autonomous farm equipment, and drone-based field analysis. Companies like John Deere (which acquired AI startup Blue River Technology), Bayer, and agtech startups are active here.

Robotics and Industry 4.0: AI for industrial robots, manufacturing process optimization, predictive maintenance in factories, and IoT sensor analytics. Siemens, Fanuc, KUKA, and Mitsubishi file patents at the intersection of AI and industrial automation.

Each segment attracts different combinations of tech firms, industry incumbents, and specialized startups, creating complex competitive landscapes. For strategists, tracking patent growth in your industry vertical signals whether you’re keeping pace or falling behind in AI adoption.

Generative AI’s breakout growth (from a niche to thousands of patents in just a few years) mirrors historical technology gold rushes, such as the smartphone patent boom in the 2000s. Some areas may become crowded with overlapping patents, underscoring the importance of freedom-to-operate analyses or patent-pool solutions to avoid gridlock.

Geographic Distribution: Where AI Patents Are Filed

Geographic patent strategy directly affects portfolio strength and competitive leverage. A patent only protects in jurisdictions where it’s granted; filing decisions determine where companies can enforce rights, demand licensing fees, or block competitors.

China Leads Volume, But Filings Remain Concentrated Domestically

By 2024, China granted nearly 13,000 AI patents, versus ~8,600 in the U.S., maintaining its volume lead. However, a critical distinction: only about 7-8% of Chinese AI patent families have been filed internationally through the PCT or directly with foreign patent offices.

Figure 3: Global AI Patent Family Share by Country (2023): China now accounts for roughly two-thirds of all active AI patent families worldwide, reflecting a dramatic shift in the global innovation landscape over the past decade. While the United States, South Korea, Japan, and Europe continue to produce influential AI inventions, their combined share is significantly smaller than China’s volume-driven dominance. The comparison underscores how national patent strategies and policy incentives have reshaped where AI intellectual property is being generated—and highlights why geographic filing patterns matter as much as raw patent counts for enforcement and competitive strategy. Source: Edge AI & Vision / AltIndex (2024); Stanford AI Index (2024).

Most Chinese organizations file via the national route through the CNIPA and do not pursue U.S. or European patents due to cost considerations, a perceived lower success rate abroad, or a strategic focus on China’s domestic market. For example, State Grid Corporation’s 13,500+ AI patent families concentrate on China’s energy sector, providing domestic dominance but minimal direct IP reach internationally.

This creates an asymmetry: Chinese companies control the massive Chinese market through patent volume, but have limited leverage for licensing or enforcement outside China.

U.S., European, Japanese, and Korean Firms: “Triad” Coverage

In contrast, companies from the U.S., Europe, Japan, and South Korea typically file essential patents across the “IP5” jurisdictions (U.S., European Patent Office, China, Japan, Korea) and additional markets such as Canada, Australia, and India.

A broad geographic footprint means patents can block competitors or require licensing in multiple major markets simultaneously. The average U.S. AI patent family is filed in ~4 countries, whereas the average Chinese family is filed in ~1-2. This correlates with citation impact; globally filed patents receive more citations because they’re more visible and relevant in international innovation networks.

Intel and Samsung, for example, routinely file AI patents in 10+ countries for significant innovations. Competitors face the complex task of designing products that don’t infringe any of these jurisdictions’ patents, which dramatically increases the difficulty compared to single-country patent coverage.

Quality vs. Quantity Reflected in Geography

Research shows U.S. AI patents average 13.2 forward citations while Chinese patents average only 1.9; part of this difference stems from geographic reach. U.S. patents participating in global innovation networks (filed across the U.S., Europe, China, etc.) are more visible and impactful than Chinese domestic patents that may not be well-known or relevant outside China.

Notable Exception: Chinese Companies Going Global

A few leading Chinese tech firms do file significantly abroad. Huawei files extensively in Europe and the U.S. (though U.S. filings slowed due to trade tensions), giving it leverage in international 5G and AI negotiations through cross-licensing with Western telecom firms.

Tencent and Baidu have increased PCT filings for important AI inventions, seeking protection in markets they aim to enter as cloud services and consumer apps expand globally. Still, this represents the minority case among Chinese AI patent holders.

Europe and Other Regions

Europe (via the European Patent Office) sees substantial AI patenting, though European companies account for a smaller market share than U.S. or Chinese firms. Germany’s Siemens, Bosch, and SAP file extensively across jurisdictions with high citation impact. German AI patents average over 6 citations each, triple China’s rate, demonstrating a quality focus.

Japan and South Korea similarly emphasize broad filing. Each country granted ~1,500 AI patents in 2024 with high citation impact. Japanese companies like Toyota and Sony, and Korean firms Samsung and LG, file globally rather than concentrating domestically.

Strategic Implications for Investors and Business Leaders

Geographic patent coverage reveals hidden portfolio strength or weakness:

5,000 China-only patents might appear strong on the surface, but they offer limited leverage for partnerships or licensing outside China. Competitors operating internationally face minimal IP barriers from these patents.

500 patents filed across the U.S./Europe/Japan/China represent stronger positioning, control over key markets, and the ability to force global competitors to navigate or license these inventions despite modest counts.

Geographic coverage hints at commercial intent: companies filing in Europe and the U.S. likely plan to conduct business or license there, while China-only filers focus on domestic markets or maintain patents primarily for defensive purposes.

Regulatory dimensions matter too: as regions implement AI regulations (such as the EU AI Act and U.S. executive orders), patent strategies may shift. EU filings could become more valuable if EU law standardizes AI compliance processes; owning patents on compliance methods could prove lucrative if every AI system needs them to meet regulations.

Patent Office Rigor Differences

The USPTO and EPO maintain stricter examination standards for software/AI patents than China’s CNIPA. The grant rate for AI-related patents in the U.S. was about 73%, versus only ~41% in China; many Chinese applications are rejected or abandoned, suggesting speculative or lower-quality filings in some cases.

Patents granted by the USPTO/EPO may have undergone more rigorous examination (patentable subject matter tests, inventive step requirements), potentially indicating higher-quality inventions. A portfolio heavy on U.S./European patents might be “battle-tested” in ways that China-only portfolios aren’t.

For companies operating internationally, a balanced global portfolio proves ideal. In-house legal teams typically use tiered approaches: file the most essential patents in 5-7 major jurisdictions, secondary innovations in 2-3 markets, and minor improvements domestically only.

Geographic distribution represents the chessboard of patent strategy, and data show that U.S./Western firms have played a more astute global game despite Chinese firms building an overwhelming home-field advantage.

Investment and Strategy Implications

Strong AI patent portfolios directly affect company valuations, competitive positioning, and long-term survival. For C-level executives and investors, understanding IP dynamics is essential for strategic decision-making. During investor due diligence, patent data is analyzed to assess the strength and strategic value of a company’s AI patent portfolio, providing insights into innovation focus and R&D investment.

Valuation Premium for IP Leadership

Companies with robust AI patent portfolios often command higher market valuations. Intangible assets (including patents, software, and data) now comprise approximately 90% of S&P 500 companies’ market value, up from just 17% in 1975. Most of a modern tech company’s value resides in intellectual property rather than physical assets.

AI patent leadership creates measurable value premiums. When evaluating startups or IPO candidates, investors examine not just technology and revenue but also what patents protect competitive moats. If two AI companies show similar metrics but one owns key patents while the other has none, the former is likely to receive a higher valuation or more investor interest.

Patents signal innovation capacity and justify “IP premiums” in stock prices or acquisition multiples. This explains why private equity and venture capital firms increasingly commission patent landscape analyses during due diligence; understanding IP strength informs valuation models.

Quality Over Quantity for Sophisticated Investors

Leading investors focus on patent quality metrics when evaluating AI-heavy companies: citation rates, claim breadth, international coverage, and whether patents cover core enabling technologies or narrow applications.

This explains valuation paradoxes where companies with fewer patents receive higher valuations than volume leaders. NVIDIA’s market cap soared in 2023-2024 partly due to its stranglehold on AI hardware (protected by strategic patents). In contrast, some Chinese AI firms with larger patent counts don’t achieve comparable investor confidence.

For investors, 100 high-impact patents demonstrably beat 1,000 low-impact ones in creating sustainable competitive advantage and pricing power.

Cross-Licensing and “IP Peace Treaties”

Major patent holders frequently enter cross-licensing agreements, reducing litigation risk while preserving market position. This is common in semiconductors and telecom, and is increasingly common in AI, allowing companies to license each other’s patents, typically with balancing payments if one portfolio is stronger.

Google and Samsung, for example, maintain broad cross-license agreements covering tens of thousands of patents (likely including AI technologies). These deals form an “IP club” of top-tier companies that can operate freely within the club but exclude those outside.

If you’re a smaller company with thin IP, you won’t be invited to cross-license and become vulnerable to infringement claims. This creates strategic pressure to build patent portfolios even for companies planning to license rather than litigate; having patents provides bargaining chips for mutual licensing deals.

Litigation and Exposure Risks

Companies without AI patents face a heightened risk of being sued or forced to pay licensing fees when using AI in their products. While AI patent litigation hasn’t yet exploded (many patents are still young), it’s inevitable as the field matures.

When AI startups with no patents compete against incumbents with portfolios, they may face pressure to license technology or risk infringement suits. This mirrors smartphone patent wars: small companies without defensive portfolios found themselves either paying royalties or becoming acquisition targets.

For example, a small AI healthcare firm might discover IBM or Siemens holds broad patents covering its algorithms. Without its own patents as leverage, the small firm must pay royalties or alter its approach, potentially losing competitive advantage or profit margin.

Patent Thickets and Barriers to Entry

Very dense innovation areas (such as generative AI and autonomous vehicles) create patent thickets, where overlapping patents from multiple owners complicate market entry. New entrants must navigate this complexity, raising costs and legal risks.

A startup might need to license multiple patents from different owners to avoid lawsuits: a daunting task when each patent holder has different licensing terms, costs, and requirements. Patent pools or collective licensing schemes (similar to MPEG-LA for video codecs) might emerge to address AI patent thickets if they become unmanageable.

In-house legal teams should conduct freedom-to-operate (FTO) analyses before launching products in highly patented areas to identify potential landmines. Companies already file preemptive defensive patents and IPR (inter partes review) challenges against competitors’ patents; these are signals of upcoming IP battles.

M&A and Talent Acquisition

Patents sometimes drive acquisitions: larger companies acquire startups primarily to secure IP (and talent behind it). In AI, major players like Apple, Google, and Meta have acquired numerous AI startups over recent years; while data and talent motivated many deals, patents often formed essential components.

If Company A holds critical patents that Company B needs, an acquisition is cheaper than licensing or litigation. This happened repeatedly with smartphone patents and will likely occur in AI, particularly if small companies patent foundational algorithms that giants need.

Investor Due Diligence Requirements

Patent due diligence is now standard when evaluating AI companies. Investors verify whether a company’s core IP is patented and whether it potentially infringes others’ patents. Companies without patents or a clear IP strategy may be discounted due to weaker moats or legal risk.

Conversely, if a company holds a few strategic patents (say, covering key techniques in federated learning for data privacy), this significantly raises investor confidence in its long-term competitive edge and premium pricing potential.

AI patents have become currency in tech: they buy freedom to operate, enable partnerships via cross-licensing, and create investor trust. But only if they’re the right patents; low-quality, high-volume patents won’t save companies from lawsuits or justify billion-dollar valuations.

Boards and CFOs increasingly ask: “What’s our IP position? Do we have defensive patents? Can we monetize this?” These questions tie directly into strategic planning, M&A strategy, and capital allocation.

For companies without strong patent positions, strategies include: partnering with patent-rich firms (joining their ecosystem for protection), licensing needed technology early (though this hits margins), or contributing to open source (creating de facto standards hard for others to patent). Each approach involves tradeoffs, but ignoring IP is no longer viable.

Future Outlook: Will One Company Keep The AI Patent Crown?

The AI patent landscape continues evolving at extraordinary speed. The transformative potential of AI is driving the strategic importance of patent portfolios, giving companies significant market advantages as artificial intelligence reshapes industries and daily life. Several trends will reshape leadership through the late 2020s:

Chinese Volume Leadership Likely Persists

Expect Baidu, Tencent, Ping An, Huawei, and other Chinese giants to maintain top volume positions through 2028-2030. China’s national AI focus remains strong; companies face incentives to file patents, and emerging AI subfields (AI for semiconductors, AI in education, biotechnology AI) will see a flood of Chinese filings.

By 2030, China’s share of global AI patents might reach 75%+ if current trends continue. However, global influence depends on whether more Chinese inventions reach world-class quality and receive international patent protection: a shift that would require strategic changes in both government policy and corporate IP strategy.

U.S. and European Focus on Foundational Breakthroughs

American firms and some European/Japanese/Korean players will likely focus on patenting foundational technologies: next-generation model architectures beyond transformers, breakthroughs in AI algorithms (perhaps neuromorphic AI, quantum AI algorithms, or post-deep-learning paradigms), and critical applications such as AI for climate technology or AI safety systems.

Quality-wise, these should maintain the West’s influence edge. Areas like edge AI, federated learning (privacy-preserving AI), and AI safety/explainability are poised for growth. As privacy laws restrict centralized data usage, companies with patents in federated learning (training AI on-device without raw data leaving) will benefit strategically.

Expect Microsoft, Google, Apple, and academic institutions to file numerous utility patents for privacy-preserving and trustworthy AI methods; these could become required features due to regulation.

Key Battlegrounds Through 2028

Generative AI will remain a primary patent battleground as it spreads into industries (media, legal services, software development, design). Companies are racing to patent applications, specialized model architectures, and training techniques.

Autonomous vehicles and robotics stay intense, with the added twist that as these technologies mature, companies will start asserting patents more aggressively. Today, many hold off litigation while technologies remain in R&D; commercial deployment will trigger IP battles.

Healthcare AI represents a critical battleground where tech firms, pharmaceutical companies, and startups vie for core IP. AI-designed drugs and AI diagnostic tools could become cash cows, driving fierce patent competition. The pharmaceutical sector’s AI patent intensity is rising sharply, with major players like Roche dramatically increasing filing rates.

AI hardware and semiconductor integration emerge as crucial as Moore’s Law slows; specialized AI chips and the co-design of algorithms with hardware yield patentable innovations. Players like NVIDIA, Intel, AMD, and even Tesla (Dojo chip) will file extensively here.

Regulatory Influence on Patenting

Government policies will increasingly shape what gets patented and how. The EU AI Act (effective 2025-2026) defines AI system requirements; while primarily governing usage, it may indirectly affect patents. Companies might patent methods to make AI compliant, such as documentation systems, bias-auditing tools, and explainability techniques required by law.

The USPTO grapples with AI inventorship questions (can an AI be an inventor?) and patent eligibility of AI-generated inventions. If laws evolve to restrict or expand what’s patentable in AI, the landscape will shift dramatically.

Some countries might push for open-source or standards that limit patent exclusivity in critical areas; if AI is deemed crucial to the public good, there could be pressure for royalty-free licensing in healthcare AI or safety-critical applications. This remains speculative but is worth monitoring.

Quality vs. Quantity Gap May Persist or Widen

Unless China dramatically shifts incentives toward patent quality rather than volume, expect the pattern to continue: China produces the most patents, but the U.S. and allies produce fewer with greater per-patent impact.

However, China recognizes this critique. Chinese officials discuss transitioning from “made in China” to “invented in China” with genuine high-quality IP. If Chinese companies start filing more globally and investing in fundamental research, the quality gap could narrow. Companies like Huawei and Alibaba already invest heavily in fundamental AI research with corresponding international patent filings.

From the U.S. perspective, strategies such as the CHIPS Act and increased R&D funding aim to maintain innovation leadership, translating into patent dominance in strategic areas. Government funding for AI research in advanced materials, biotech, and national security applications will yield patents at the technological frontier.

New Players and Dark Horses

By 2026-2028, the “most AI patents” leader might surprise observers. Potential scenarios:

- Microsoft + OpenAI integration: If their partnership deepens or Microsoft acquires OpenAI, combined portfolios could vault rankings.

- International AI consortia: New collaborative entities pooling research and IP could emerge.

- Mega-startups: Well-funded AI-native companies building massive patent portfolios rapidly.

However, given patent-pipeline timelines (accumulating thousands of patents takes years), today’s leaders will likely remain leaders in the near term. Dramatic shifts require sustained investment, time, and a well-considered Freedom-to-Operate (FTO) strategy.

Geopolitical IP Arms Race

At a geopolitical level, AI patents are part of the U.S.-China tech competition. Both countries view AI dominance as crucial for economic and national security. Patents serve as scorecards in this competition.

We might see increased government involvement in patent strategy: the U.S. streamlining specific patent processes for strategic technologies, or China creating global patent funds helping its companies file abroad more aggressively.

There’s also fragmentation risk: if U.S.-China decoupling continues, we could see parallel innovation worlds (Chinese patents affecting China, U.S./Western patents covering the rest, with limited overlap). Global companies prefer to avoid this inefficiency, but geopolitical tensions may force them to adopt it.

Product vs. Patent Race

Winning the patent race doesn’t guarantee winning the market race. Execution, data advantages, and talent matter equally. Meta took a relatively open approach by releasing LLaMA model weights, focusing less on patenting those specific models. This helped gain developer mindshare quickly.

Meta does file AI patents (especially in AR/VR and social media AI), but isn’t aiming for the top patent charts; instead, it’s leveraging the community and open source to compete. This strategic choice could pay off in adoption even if others patent around Meta’s ideas.

Companies that truly “win” AI will combine robust patent portfolios with standout products, unique data assets, and strong execution. Patents are insurance: necessary but not sufficient. You still need to build superior technology and achieve widespread adoption.

From an investor standpoint, ideal AI companies have both cutting-edge products and patents that protect long-term competitive runways. Patents form part of the moat, but not the entire moat. Analysts look for companies that can dominate markets not just this year but for the next decade; having core AI patents is one indicator of that durability.

Understanding who holds the most AI patents provides a window into future tech competition. It reveals which companies and countries are positioning themselves with defensible innovation and where the subsequent battles will occur. For founders and CTOs, it underscores the importance of IP strategy aligned with business goals, particularly for tech startups where patent positioning can mean the difference between securing funding and being blocked by competitors. For CFOs and legal teams, it’s a reminder that IP risk and value should be integrated into corporate planning, not treated as an afterthought after products are built.

For all of us following the AI revolution, patent trends offer insights that product announcements and press releases often miss: a behind-the-scenes look at where the real technological bets are being placed and which companies are building the foundations that will define AI’s next decade.

Your Next Steps to AI Patent Strategy Success

Suppose you’re developing AI technology, whether machine learning algorithms, generative AI tools, or AI-powered SaaS applications, the patent landscape we’ve explored reveals both opportunity and complexity. The 800% growth in generative AI patents since 2014 shows innovation happening at breakneck speed, but it also means the window for securing foundational claims is narrowing.

The bottom line: Weak AI patents offer minimal protection, making it easy for competitors to design around your innovations. Strong, strategically filed utility patents directed toward AI technology create enforceable barriers that force competitors to either license from you or invest heavily in alternative approaches, giving you negotiating leverage, investor confidence, and long-term competitive advantage.

Time is critical. The U.S. operates under a first-to-file system, meaning whoever files first wins priority rights, regardless of who invented first. While you’re perfecting your AI model or building your SaaS platform, competitors may already be filing patents on similar concepts. Once prior art exists, your ability to secure broad patent claims narrows dramatically. Every day of delay can cost you patentability for innovations you’ve already developed.

Take these immediate actions:

- Schedule a Free IP Strategy Call with our patent team to evaluate the patentability of your AI technology and develop a protection plan tailored to your market position and funding stage. We’ll identify what’s patentable now and create a filing strategy that maximizes protection while managing costs.

- Download our AI Patent Mastery Guide to understand precisely what AI innovations qualify for patent protection, how to identify patentable elements in your technology, and common mistakes that weaken AI patent applications.

- Review our SaaS Patent Guide 2.0 if you’re building AI-powered software; it covers international filing strategies, cost management, and how to structure claims that survive patent office scrutiny.

- Conduct a competitive patent landscape analysis to identify overlapping claims from major players and potential freedom-to-operate issues before you launch or seek funding.

Looking ahead: Strategic AI patent protection isn’t about accumulating volume; it’s about securing enforceable rights in markets that matter, with claims broad enough to provide real competitive barriers. The companies that will dominate AI’s next decade are filing those patents today, while competitors are still deciding whether patents matter.

At Rapacke Law Group, we specialize in protecting tech innovations, particularly AI and software patents for SaaS founders and innovative startups. Our fixed-fee model eliminates billing uncertainty, and our experienced U.S. patent attorneys guide you through the entire process from prior art search to filing strategy to office action responses. Don’t let patent complexity or cost concerns leave your AI innovations unprotected while competitors secure the IP landscape around you.

To Your Success,

Andrew Rapacke

Managing Partner & Registered Patent Attorney

Rapacke Law Group