Cryptocurrency was first invented in 2008 with the release of Bitcoin, the first public digital currency characterized by decentralized control, user anonymity, and verification that includes record-keeping using network technology and blockchain ledgers. Although the terms “cryptocurrency” and “Bitcoin” are often used interchangeably, today there are over a thousand different types of cryptocurrencies with a global market cap of over three trillion dollars. No longer embraced solely by tech enthusiasts, cryptocurrencies are becoming increasingly mainstream and more than 30% of millennials are investing in these digital assets.

Although cryptocurrency started as a means of providing peer-to-peer transactions, larger companies, such as banks and credit card companies, have utilized cryptocurrency for investment, operations, and transactional purposes. Improvements to the technology have enabled real-time and secure transfers, risk mitigation, and enhanced security protocols and regulation. The surge of these disruptive technologies has led to a flurry of issued patents. This has increased cryptocurrency’s visibility and encouraged new inventors to enter the market and integrate cryptocurrency into their new startup ventures. For emerging startups who may not understand how their software applications, cryptocurrency, and/or blockchain technology may be proprietary, this article will provide an overview of how best to patent crypto-enabled innovations along with granted cryptocurrency patent examples.

Why it’s Important to have Cryptocurrency and Blockchain Patents?

Cryptocurrency is the most frequently used blockchain technology, allowing for peer-to-peer transactions to be completed and maintained in a distributed public forum with an established decentralized record of transactions. Using blockchain technology, each transaction is stored in an unmodifiable public ledger, which identifies the transaction by assigning an address that guarantees the security of the data record without the need for a third-party intermediary. Each transaction is approved through a “mining” process, which works to solve a complex computational problem and once solved, adds a block to the chain which holds sets of information and data. As traditional databases use tables to store data, the blockchain creates an irreversible timeline of information that is assigned an exact record of the time when it is added to the chain.

Many courts have rejected cryptocurrency patent applications in recent decisions on the basis that the invention is not patent eligible subject matter, since it is directed to a judicial exception. For years software and related cryptocurrency patent applications were rejected as “abstract” and found to be simply “organizing human activity” or merely using generic computer functions. Under the requirements of 35 U.S.C. 101, applicants must demonstrate that the technology underlying the software has been modified to achieve a specific result. Although questions remain regarding how cryptocurrency can be patented, under patent law an invention must:

- Be a new, useful, and non-obvious process, machine, manufacture, or composition of matter (a statutory claim); and

- Not be abstract, a law of nature, or a natural phenomenon (a judicial exception).

In general, any cryptocurrency innovation that improves technological functionality or produces a tangible result is patent eligible subject matter. The challenge in patenting cryptocurrency is to craft and submit a well-articulated claim set and detailed description that demonstrates how the novel cryptocurrency technology improves computer functionality and/or employs a technical solution to a known technical deficiency. The patent application should include a clear and thorough analysis and description of all systems, subsystems and components that implement this proprietary process or method.

Cryptocurrency Patent Examples

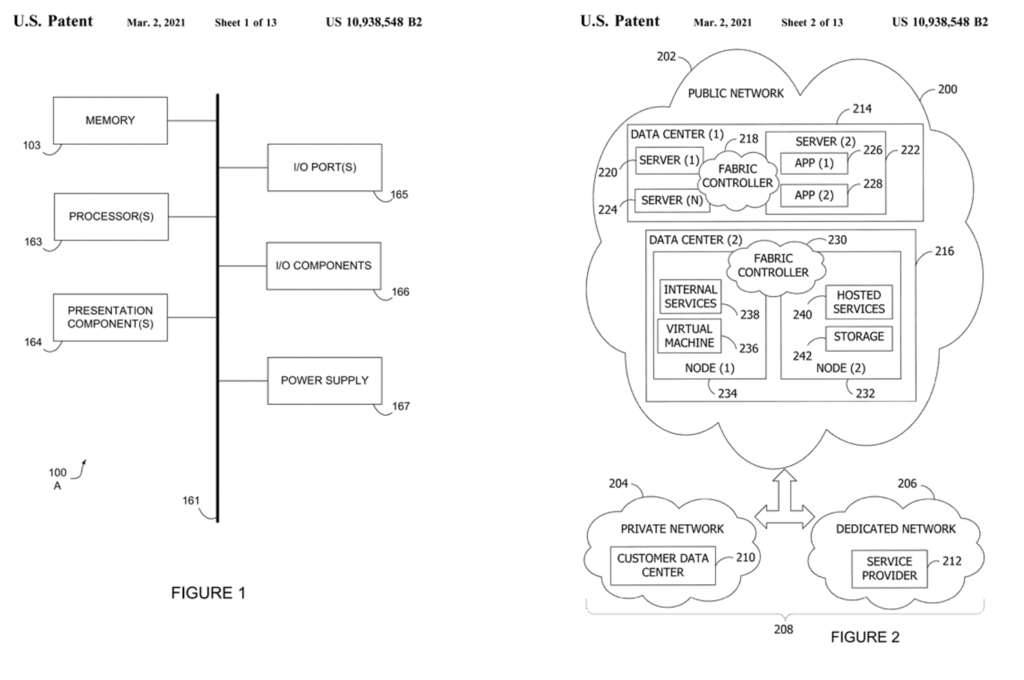

Microsoft Technology Licensing, LLC – Blockchain Object Deployment and Synchronization Across Blockchains

In 2017, Microsoft Technology Licensing, LLC submitted a patent application for “Blockchain Object Deployment and Synchronization Across Blockchains.” The application resulted in a patent for a computer system that utilizes blockchain technology to store data and interact with other blockchains. Some of the technical issues the invention sought to overcome included parameters (e.g., person, role, action) of a smart contract that may be stored on one blockchain and associated with another. The patent relates that a blockchain may receive a series of events from an event stack in the system, which may or may not be associated with a second blockchain. Different versions of the smart contract may also be stored on multiple blocks. The claims are for a blockchain event interface system that includes a hardware processor that enables a processor to receive parameters for a blockchain object based on specifications in the context scheme; create a first blockchain and deploy information from the first blockchain onto a second blockchain with a separate set of instructions than the first blockchain; enables a blockchain to receive updates from a separate blockchain; enables interaction between blockchains even if one is private, one is public or both are private.

Figure 2 illustrates cloud system components that may be used to build an event interface system for blockchain objects according to an embodiment.

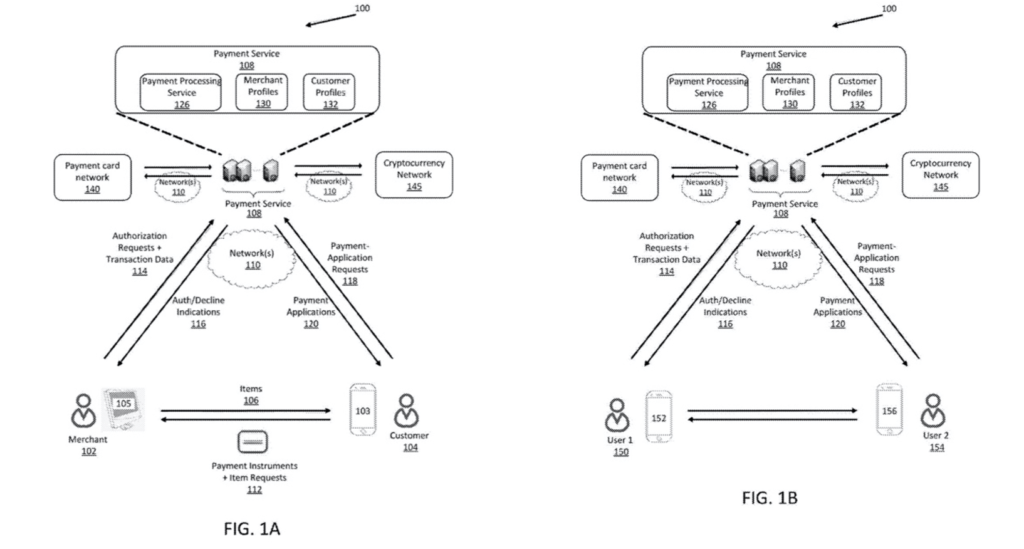

Square, Inc., LLC – Cryptocurrency Payment Network

In 2018, Square, Inc. submitted a patent application for a “Cryptocurrency Payment Network.” The application disclosed a system to facilitate transactions where a merchant’s request is specified in fiat currency. The claimed system permits a customer to pay for a transaction using cryptocurrency and calculates the value of the payment based on an exchange rate to fiat currency. The system further initiates transfer of the cryptocurrency from the customer to the merchant, initiates a transfer of a value of the fiat currency to the merchant, and generates a record of the transaction between the customer and the merchant. The patented system addresses the need for a payment service capable of handling a broader range of currencies, including fiat currencies. This is especially timely as new cryptocurrencies continue to emerge and continue to grow in popularity.

Figure 1B illustrates an example of a payment service network according to an embodiment.

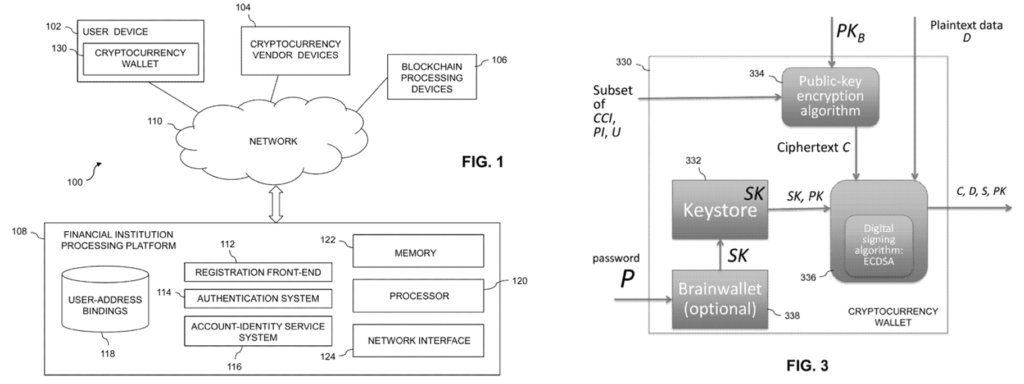

Cornell University – Systems and Methods for Securing Cryptocurrency Purchases

In 2016, Cornell University submitted a patent application related to cryptocurrency securities for “Systems and Methods for Securing Cryptocurrency Purchases.” The application included description of a processing platform that creates a database to store bindings between a user’s identity and a cryptocurrency address. This creates an account-identity system that verifies whether a user has the credentials bound to the cryptocurrency address associated with the requested purchase and ensures that a user cannot fraudulently refute payment at a later date. The patent addresses systems, methods, processing devices, and computer programs with distinct software code. Some of the claims include the registration, purchase mechanics (including determining the user’s identity), fraud claim investigation methods, configuration of the processing platform, a method of storing bindings in a database, receiving queries, and generating a response.

Figure 3 illustrates an example of a cryptocurrency wallet configured to implement the wallet-related operations according to an embodiment.

How Best to Protect your Cryptocurrency and Blockchain Technology?

While initially wary and even hostile to cryptocurrency, large, institutional players are now taking a keen interest in cryptocurrency. Nevertheless, there are still certain risks with innovations in the field. For example, some tech companies and startups understand the value in their intellectual property and pursue early patent protection before new aspects of cryptocurrency and related technologies are fully developed to build a strategic defensive patent portfolio for future licensing or a defensive litigation strategy.

In order to protect your innovation as an emerging startup or cryptocurrency developer, it is important to prepare a detailed and comprehensive patent application as early as possible in the development process. The USPTO operates on a “first to file” patent application priority basis, so filing early can help ensure that others may not effectively preempt your legitimate claims to your cryptocurrency related innovation. Failing to be proactive about securing protection for your intellectual property may result in disputes and challenges down the road or even eliminate certain innovation from the market altogether.

As stated earlier in this article, not all new cryptocurrency developments may be patent eligible. Innovation is likely to face challenges and rejections from the USPTO if it merely relies on changing how an existing technology is used, without providing a solution to a real-world problem. For example, the decision in the Supreme Court case Alice Corp. v. CLS Bank Int’l found that a patent granted for claims to methods relating to an electronic escrow service were ineligible for patent protection, since they represented an abstract concept.

Challenges associated with protecting cryptocurrency innovations also arise due to the open source nature of the underlying software. Open source software is characterized by collaborative development and the code is publicly available, intending to be a public good instead of a private asset. The Bitcoin core reference client, for example, is the result of over 15,000 code contributions from unaffiliated developers. This code is available under a permissive license, which provides for minimal limitations as to how the software can be used, modified, and redistributed. The open source nature of the technology can make it difficult for innovators to keep their trade secrets private and can reduce their market competitiveness. For aspects of the innovation that are patent eligible, it is important to carefully prepare the patent application to include a robust description of the nature of the invention, its description, and the claims.

In addition, although aspects of cryptocurrency can be patent eligible, because the technology is relatively new there is limited case law to rely on from any courts. This will change as more patents are awarded and the patent landscape continues to develop. The rapidly evolving nature of cryptocurrency technology and court decisions will continue to define the legal authority in the space as further precedent is established. A patent attorney is best equipped to assist innovators with identifying which elements of their cryptocurrency inventions are patent eligible and determining the best strategy to protect it’s crypto-enabled technology.

An Experienced IP Attorney Can Help You to Protect Your Cryptocurrency Innovations

There’s no doubt that new technological advancement and disruption in the FinTech sector will continue through 2022 as traditional financial institutions and technology sectors both actively invest in cryptocurrency. Ensuring you have the right intellectual property protections and competitive intelligence in place will position your company to protect it’s valuable crypto-enabled innovations while staying one step ahead of the competition. Failure to adequately identify and protect your proprietary technology may not only lead to competitors gaining an upper hand but profiting off your hard work.

The Rapacke Law Group is a fixed fee intellectual property law firm with a focus on software-implemented technologies including Cryptocurrency, Blockchain, FinTech, and SaaS platforms. If you have questions on how best to protect your FinTech inventions, call for a free consultation or take our Intelligent IP Quiz to help you identify what type of protections are best for your business.