In the current business landscape, patents are more important than ever. They provide companies with a competitive advantage by protecting their intellectual property (IP). When it comes to FinTech startups, patents can have a major impact on valuation. In this blog post, we’ll take a closer look at the role of patents in FinTech and how they can affect startup value. We’ll also explore some strategies for securing patent protection for your FinTech startup’s innovation. So, if you’re interested in learning more about the impact of patents on FinTech valuation, keep reading!

What is a patent and why do FinTech companies seek them out?

FinTech stands for “Financial Technology” and is the result of the integration of financial products and services with technologies that improve and/or automate existing products/services or create new ones. FinTech is behind advances in blockchain, cryptocurrencies, NFTs, and other similar technologies. Just like there are different players in the financial industry (commercial banks, investment banks, stock markets, brokerage firms, insurance companies, financial advisors and wealth management firms, etc.), FinTech patents are generally directed to one or more of a broad range of financial sectors and services, including internal banking systems, investing technologies (such as robo-advisors and automated investing), payment systems, blockchain/cryptocurrency/NFT, cybersecurity/financial security, and financing.

Why are FinTech patents crucial for success? Because patents protect technological innovations. FinTech businesses are built upon technological innovations that take significant amounts of time, effort, and resources for their development. A disruptive technology can dramatically affect the financial industry and have ripple effects into other sectors of the economy. However, failing to secure patent protection for a disruptive technology leaves competitors with the open opportunity to copy that technology. Simply put, FinTech companies need FinTech patents so that their technologies are protected and their market share can expand.

How do patents protect technologies? A patent allows the patent owner (the inventor or an assignee) to exclude others from making, selling, or using the claimed invention for a period of time. The claims specify the scope of patent protection. When people talk about “infringing a patent,” they are referring to infringing one or more claims of the patent. With a FinTech patent issued, FinTech businesses can send cease and desist letters or file a lawsuit in Federal Court against parties that have infringed their patent.

FinTech businesses will generally seek to protect software inventions with patents, particularly those related to blockchain, cryptocurrency, cybersecurity, SaaS/Internet/Cloud services, robo‑advising, mobile transactions, and business method technologies (see our article on Patents for FinTech Software, which also discusses design patents for GUIs – Graphical User Interfaces).

A patent is a grant by the U.S. Patent and Trademark Office embodied in a legal document that contains:

- Technical information about an invention, including a short abstract, a summary, figures (drawings), a detailed description, and

- One or more claims that describe the meets and bounds of the invention.

As explained in our Can You Patent An Algorithm article, in the United States a patent can be granted for technological advancements or discoveries that fall into one of several categories that have been codified in 35 U.S.C. 101. These categories of patentability are:

- Processes,

- Machines,

- Manufactures, and

- Compositions of Matter

How do patents impact the valuation of a company in the FinTech industry?

When performing a valuation, someone is making a determination of the value of company. One of the things they are looking for is the company’s technology and whether it is covered by patent protection.

Large institutions rely on their bargaining power and intellectual property to block competitors and newcomers from capturing their valuable market share. Startups rely on the disruptive aspect of their innovations to capture or grow market share. When measuring the value of a business, whether an incumbent in the market facing a new disruptive technology or a newcomer launching the latest innovation, the protection of those innovations with patents lets others know whether the innovations and technologies at issue are proprietary or are up for grabs by anyone in the market. As explained above, businesses that protect their innovations with patents are able to exclude others from making, selling, or using the claimed invention, which gives those businesses a competitive advantage. That competitive advantage results in higher valuations.

Not convinced? Check out the following examples of how patents and patent applications have been used in the FinTech space to increase value

# 1. Cryptocurrency payment network

Square, Inc.

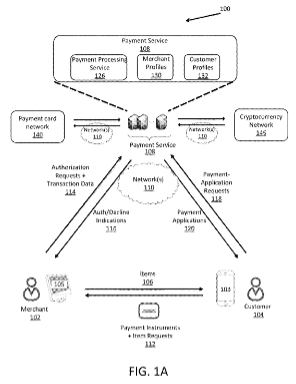

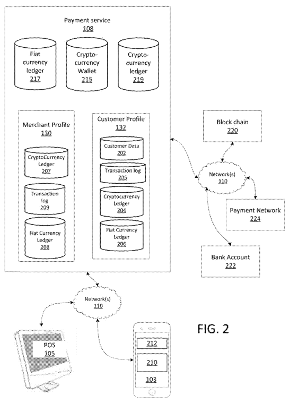

This patent is directed to methods of settling transactions in real-time (in other words, real‑time transfers) between two parties through “a payment service” (meaning Square, Inc.) while avoiding the volatility of exchange rates between fiat currencies and cryptocurrencies.

Fig. 1A shows a block diagram of a payment service network that implements the real-time transaction settling technology.

Fig. 2 shows a block diagram with more details regarding the internal elements of the payment service.

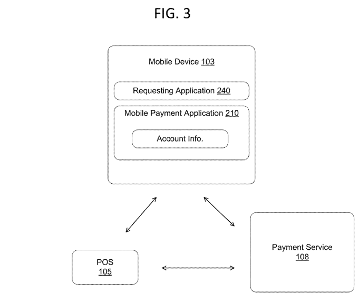

Fig. 3 is a block diagram of a mobile device with a payment application that incorporates elements of the real-time transaction settling technology.

With this patent, Square is protecting a technology that allows individuals and businesses to make payments and transfer funds instantly, including when such transfers are between two different fiat currencies and between fiat and cryptocurrencies. Technologies directed to transfers between different currencies can impact all financial sectors, from business-to-customer transactions to foreign exchange markets.

# 2. Digital Passport with Verified Data Provenance

Bank of America Corporation

US Patent Application Publication No. 2022/0109960 (US Patent App. No. 17/552,387)

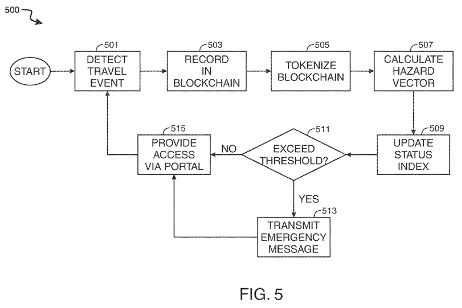

According to the patent application’s abstract, Bank of America is seeking to cover and claim “systems and methods for accurately and securely assembling, storing, and leveraging travel data” that includes “detecting a travel event of a user” or “recording the travel event in a travel map that is stored in a database,” with the travel map “stored as a blockchain ledger.” The method allows “tokenizing sensitive information associated with the user in the database.” The method also allows the calculation of a hazard vector based on a first location and a second location of a travel event. This patent application combines the concepts of a security system and a digital wallet via blockchain implementation.

Fig. 5 shows a flowchart of a method that tokenizes the sensitive information in the blockchain.

The hazard vector of Bank of America’s patent can be used to inform travelers of potential travel risks. Users can use an app incorporating this technology to verify whether travel presents a risk level exceeding a predetermined threshold. Furthermore, the technology includes storing a user’s travel data and provides users with blockchain-based security features for travel that can be combined with other blockchain-based and non-blockchain technologies, such as crypto-wallets, digital wallets, and online calendars. The combination of multiple features that are often interrelated, such as paying for travel, coordinating travel data and details, and assessing risk in travel events, makes this patent application a potential high-value asset.

# 3. Controlling a Spending Account based on User Spending Habits

Capital One Services, LLC

This patent is for a technology that allows for a user to receive authorization for monitoring a user’s spending account, establish a base-line spending profile and a dysfunctional spending profile, and determining whether a pending purchase falls under the base-line spending profile or the dysfunctional spending profile. When a purchase falls under the dysfunctional spending profile (or is otherwise not in accordance with the base-line spending profile), a temporary second approval is required, and a secondary approval person is electronically notified that their approval is required.

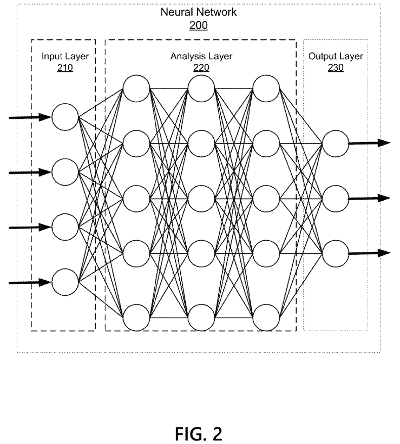

This technology leverages neural networks to determine whether purchases are or are not in accordance with the base-line spending profile. Fig. 2 shows an exemplary neural network that can have parameters (such as weights and activation functions) that implement aspects of the technology.

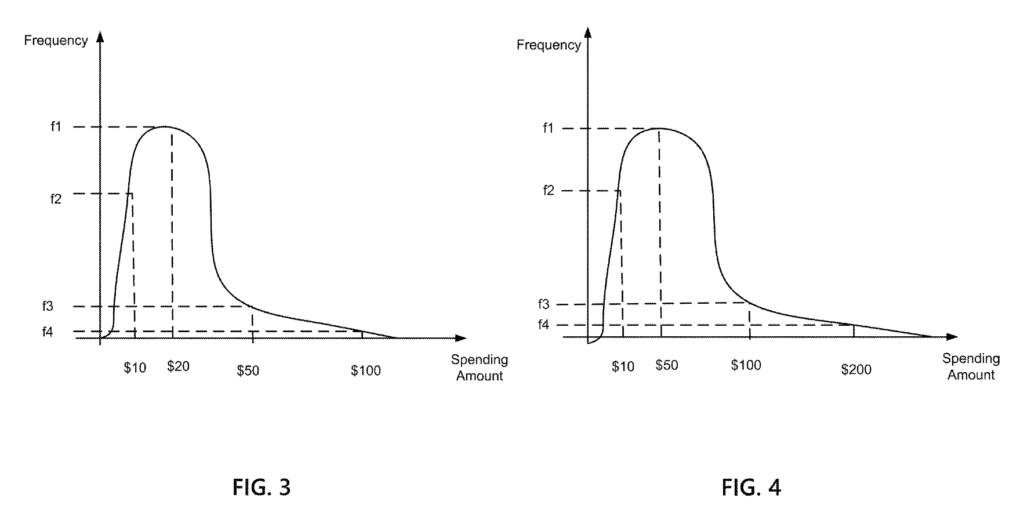

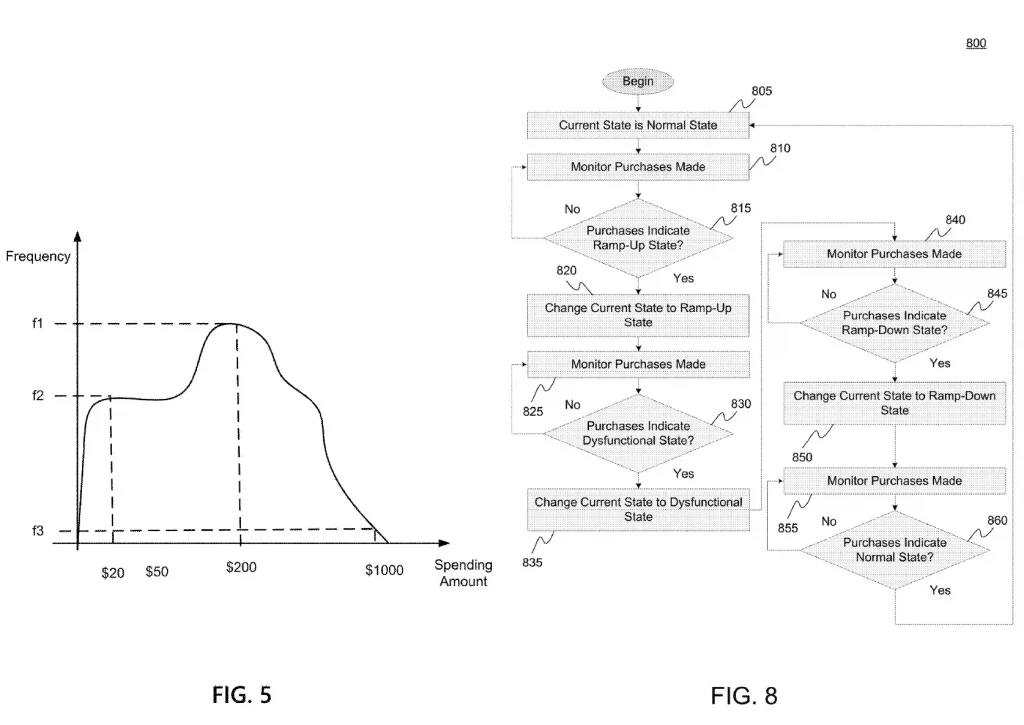

Figs. 3, 4, and 5 show a frequency versus spending amount Fast Fourier Transform plot of a user’s spending habits when in a normal mental state, when transitioning from a normal to a dysfunctional mental state, and when in a dysfunctional mental state. Fig. 8 shows a flowchart for a method used by a neural network model to determine a user’s mental state based on purchases made by the user.

Here, Capital One’s patented technology protects the accounts of customers by controlling spending and curbing excessive spending habits. By implementing neural networks to make the profile determinations, the technology’s neural network model can learn (for example, update weights) and adapt to generate more accurate determinations. This technology can be used, for example, to monitor and control the spending of individuals who may be suffering from temporary or permanent medical, psychological, mental/memory conditions. Individuals who previously could not use a credit card or debit card due to temporary spending habits can use this technology to gain the independence of having more control over their finances while lowering the risk of engaging in improper spending.

Things to consider when seeking a patent for your FinTech company

- What’s in it for you?

Before filing a patent application, consider both the business and legal aspects of patent protection. On the business side, ask whether patent protection gives you a competitive advantage. A competitive advantage can follow from protecting a technology implemented by your business. Patents can also protect market share by covering (and prohibiting your competitors from implementing) technological alternatives to your products/services.

- Am I covered?

It is a common misconception that one patent is enough to cover one product and/or service. Consider all the effort, time, and innovation that went into developing your technology. This is an area where a full discussion with your patent attorney will pay off. An experience patent attorney will bring up topics like how to foster the development of an innovation culture in your business, how to develop a budget for intellectual property protection, and can provide you with one or more invention disclosure forms to routinely use to record and transmit potential innovations for evaluation and patent protection.

- What is covered?

When patent attorneys say that “software is patentable,” they are not talking about the code. Instead, software patents are directed to the methods, processes, solutions, designs, and/or the systems that the code is implementing. Even if you cannot wrap your mind around these concepts, an experienced patent attorney will know what questions to ask you and your inventors in order to gather the necessary information to protect your technologies.

- If it is not in the patent application, it will not be covered

Likewise, if you do not tell your patent attorney about a key element of your technology, your patent attorney will not be able to describe that element in your patent application. In some instances it might be advantageous to choose to keep a technology private and undisclosed. For example, some businesses choose to maintain certain technologies as trade secrets. However, there are risks associated with this approach, including independent development by competitors. Furthermore, trade secret laws generally require the implementation of protective measures, such as contracts that require non-disclosure of the trade secrets and limitations on the number of people with access to the secret information. Be candid with your patent attorney about what your goals and why you do not want published in your patent application.

How can you make sure that your patent application is strong and will hold up in court if needed

There are things you can do to improve the chances that your patent application will be granted, and that it will be a solid patent. First, consider a prior art search (sometimes called a relevant art search). Often, inventors provide their patent attorney with basic, yet incomplete information about their innovations and technologies. If such disclosures went directly into a patent application, the USPTO Patent Examiners, that the Patent Trial and Appeals Board, or the Federal Courts might strike down the patent application or patent (yes, a bad patent, even after granting, can be struck down). How can a prior art search help? By looking at prior published patents and patent applications, an experienced patent attorney can evaluate whether the information about your technology is already publicly available. Reviewing patents from competitors can also provide you with insight and competitive intellectual property intelligence.

You may also want to ask yourself what you consider to be the key concept (or concepts) of your invention. What acts or technologies from a competitor would you consider to be infringing (copying of your invention) if you saw them? What are alternatives to the manner in which you are solving a particular problem and/or what are alternatives to your solution or technology that provide the same results? Discuss these questions and answers with your patent attorney.

Are there any other ways to protect your intellectual property beyond patents?

Yes. Other forms of intellectual property protection include trade secrets, copyrights, and trademarks.

- Trade secrets

Trade secrets are often described as the opposite of a patent because patents are published while trade secrets are unpublished. But there is more to it. As explained above, patents are limited to a particular set of categories (processes, machines, manufactures, and compositions of matter). Generally, trade secrets have no such limitations. Any information that is not publicly known and that provides a business/competitive advantage could be maintained as a trade secret. Examples of trade secrets include a list of client’s addresses and/or birthdates, a list of suppliers and vendors, know‑how related to a manufacturing process, and business plans and strategies. While patents have a set expiration date, trade secrets may be maintained indefinitely.

- Copyrights

Copyrights protect the expression of ideas in tangible media. This can include code stored on a computer (including source code, object code, and pseudo code), graphical/visual interface features (similar to paintings and drawings), and text regarding your FinTech software (including user manuals and internal guides).

- Trademarks

Trademarks are source indicators. A trademark is how you distinguish your brand, in the market place and can be a word, phrase, slogan, logo, and even a sound or a smell. Keep in mind that there are both Federal registers of trademarks with the USPTO and State registers. Strong brands can distinguish your business, with customers associating the brand with the quality of your products and/or services.

Keep Contracts in Mind

While often overlooked (even by experienced patent attorneys that lack business and/or litigation experience), you should make sure that anyone working for you and/or for your business has agreed in a written contract to assign their intellectual property rights to you or to your company. You need to take this a step further when hiring software developers and make sure they cannot reassign the work they have been assigned to others (or that they agree to have those subcontractors or third parties assign their intellectual property rights to your business). You should also make sure that they originate all their work, meaning that your employees and contractors should not copy the code from other sources, and that if they are going to use any packages, libraries, frameworks, or any other type of tool, make sure that you get the ownership or a proper license that matches the purpose of the software/solution that you are developing.

Talk with a team committed to protecting businesses

Protecting the intellectual property of a business has many moving parts. Consult an Experienced FinTech Patent Attorney. The Rapacke Law Group is a business and intellectual property law firm built for the speed of startups, with business and patent attorneys experienced in software and FinTech technologies. No hourly building, no charges for calls or emails. We offer patent and intellectual property legal services for a transparent flat fee. Contact us to schedule a free consultation with one of our experienced attorneys.