By Andrew Rapacke, Managing Partner, Registered Patent Attorney

Bank of America’s AI patent portfolio exploded 94% between 2022 and 2024, reaching nearly 1,100 patents: more than any other financial services company. This isn’t defensive stockpiling. When Icelandic startup Lucinity secured a patent for federated learning in fraud detection, it used the patent to pilot cross-border AML cooperation with the Bank for International Settlements. When FICO patented 10 responsible AI innovations in 2025, it built them into products that support millions of credit decisions daily. This surge is part of a broader trend: fintech patent filings have increased rapidly, underscoring fintech’s strategic importance in protecting innovation and maintaining competitiveness.

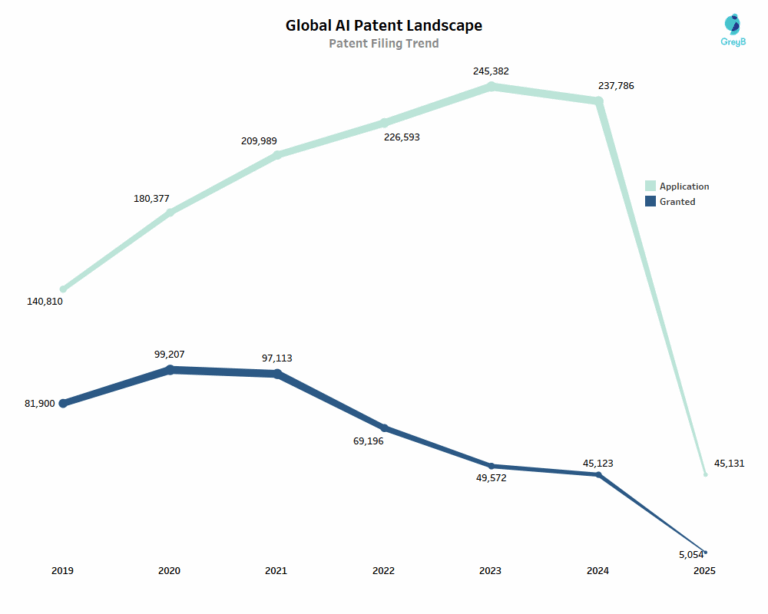

The patent surge reflects a fundamental shift in financial infrastructure, especially within the banking and financial services sector. AI-related patent filings in the financial industry increased significantly over the past five years, with approximately 190,000 AI patents granted worldwide between 2000 and 2022.

Figure 1: Global AI patent grants accelerated sharply after 2017, signaling AI’s shift from experimental research to core commercial infrastructure, based on data from the National Science Foundation and the USPTO’s Artificial Intelligence Patent Dataset.

But here’s the counterintuitive reality: most AI fintech patents fail. The USPTO’s Alice decision kills applications that automate financial processes without technical innovation. The Federal Circuit’s April 2025 Recentive decision invalidated machine learning patents for broadcast scheduling because they “do no more than apply established methods of machine learning to a new data environment.”

The winners understand a critical distinction. You can’t patent “using AI to detect fraud.” You can patent a federated learning architecture that enables banks to jointly train fraud models without sharing customer data, thereby addressing technical challenges in distributed computing and homomorphic encryption. You can patent a concept drift detection system that monitors machine learning models for data pattern shifts and dynamically adjusts to prevent accuracy degradation, addressing a specific technical challenge in model maintenance.

This article examines what actually works: the technical thresholds that satisfy patent examiners across jurisdictions, real patents from 2020-2025 that cleared eligibility hurdles, and strategic approaches that align patent protection with business reality. Whether you’re building your first AI lending platform or managing portfolios at a major institution, the path from innovation to enforceable patent follows specific technical and legal patterns.

The Rise of AI Patents for Fintech

The numbers tell a story of acceleration, not just growth. AI patent applications at the USPTO increased nearly exponentially from 2000 to 2020, with the USPTO’s Artificial Intelligence Patent Dataset identifying AI content in over 15.4 million U.S. patent documents published from 1976 through 2023. Financial services account for a significant share: AI-related patent filings in finance have risen year over year since 2018.

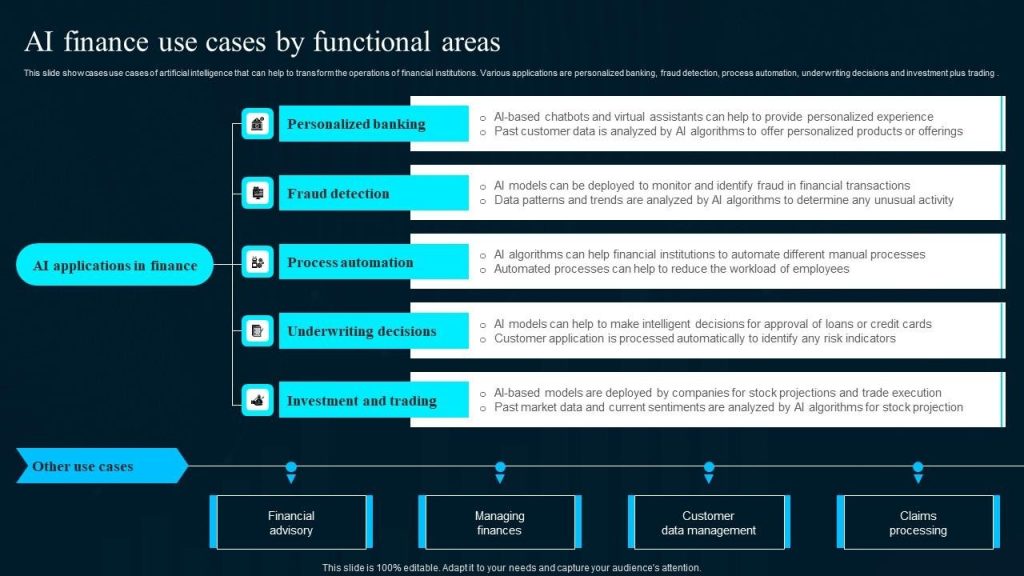

The focus areas reveal strategic priorities. More than 40% of AI patents in finance pertain to fraud detection and risk management. This isn’t a coincidence, given that financial firms are combating increasingly sophisticated cybercrime. JPMorgan Chase filed over 500 AI-related patent applications in the last decade, spanning AI-powered trading, data security, and automated analysis. The top five global banks collectively hold more than 5,000 AI patents.

Figure 2: Distribution of AI-related patent filings in financial services by use case, showing that fraud detection and risk management account for the largest share of AI innovation, followed by trading, payments, compliance, and customer analytics, reflecting where technical AI advances deliver the greatest operational and regulatory impact in fintech.

This represents a stark departure from early-2000s business-method patents, which focused on process flows and interfaces. Modern filings detail neural network architectures, gradient boosting algorithms optimized for transaction data, graph-based models for network analysis, and embeddings for behavioral pattern detection. Getting a patent requires clearly explaining how your AI model operates, including how it’s trained, the data it processes, and its decision-making process. This technical rigor and transparency are what patent examiners look for.

The sophistication shows in technical specificity. Patents now claim custom attention mechanisms that weight market signals differently during volatility, novel graph-embedding techniques that process cross-border payment flows in real time while preserving privacy through differential privacy, and hybrid cloud-edge deployment architectures that enable sub-second liquidity decisions during market stress.

For SaaS founders building AI-powered financial tools, understanding these technical requirements matters. Your innovation isn’t just about what your AI does; it’s about how your implementation solves specific technical challenges that patent examiners recognize as genuine advances beyond existing methods. This is where our AI Patent Mastery resource provides deeper guidance on positioning your AI innovations for maximum patent protection.

The Global Patent Race

Geography shapes both volume and approach. China obtained approximately 40,000 AI patents in 2022 alone, compared to roughly 9,000 granted to U.S. inventors. Together, the U.S. and China account for over 70% of all AI patent filings in finance.

But raw numbers don’t tell the complete story. The European Patent Office published 5,756 AI patent applications in 2023. Europe’s stricter patentability criteria result in fewer grants but potentially stronger patents when granted. About 3% of all European patent applications are now AI-related, concentrated in areas such as regtech and risk management, where regulatory frameworks drive innovation.

Regional strengths reflect market structures. U.S. patents dominate trading algorithms and payments-processing AI, with high-frequency trading firms and payment networks driving innovation. European filings lead in compliance automation, shaped by GDPR and MiFID II requirements. Chinese patents focus on mobile payments integration and super-app ecosystems, supported by government AI initiatives.

Bank of America’s patent breakdown shows how AI pervades fintech categories: 17% are explicitly AI/ML inventions, but information security (26%), data analytics (9%), and other categories overlap significantly with AI implementations. This distributed pattern shows AI isn’t a separate category; it’s infrastructure threading through every technical domain in modern finance.

AI in FinTech Applications

The integration of artificial intelligence (AI) into financial technology has significantly transformed the financial services industry, making AI increasingly central to the evolution of how financial institutions and fintech companies operate. Today, AI in fintech is not just a buzzword; it’s a strategic move that enhances market positioning, drives investment, and creates measurable impact across the sector.

Fintech firms are leveraging AI systems to analyze vast amounts of data, automate complex processes, and deliver innovative services, but not all of these innovations are patentable. Understanding which AI implementations qualify for patent protection is critical. Our AI Patent Mastery resource breaks down exactly what patent examiners look for in AI fintech applications. For example, AI-powered chatbots and virtual assistants are now standard fintech examples, providing clients with instant, tailored support and freeing up human resources for higher-value tasks.

The surge in fintech patent applications reflects this shift, as key players in the financial services industry race to protect their intellectual property and secure a competitive advantage. Patent offices worldwide are seeing a marked increase in filings related to business methods, blockchain patents, and technical solutions that underpin the next generation of financial technology. This trend is not limited to startups; established financial institutions are also building robust patent portfolios to safeguard their innovations and support long-term value creation.

As fintech companies invest in AI-driven solutions, the stakes for patent quality increase. Weak patents don’t just fail to protect; they can also enable competitors to design around your innovations faster and more cheaply. This is why working with experienced patent counsel who understand both AI technology and USPTO examination standards is essential.

The adoption of AI in fintech has also opened new opportunities for financial institutions to improve operational efficiency, reduce costs, and access new markets. AI-driven analytics provide actionable insights that inform business decisions, while automation streamlines compliance and risk management. The result is a more agile, data-driven industry that can respond quickly to changing client needs and regulatory requirements.

However, this rapid evolution brings new challenges. Fintech companies must ensure that their use of AI is responsible, transparent, and compliant with data protection laws. Protecting customer data, preventing fraud, and maintaining ethical standards are now as important as technological innovation itself. Intellectual property experts emphasize that a strong patent strategy must go hand in hand with robust governance and compliance frameworks.

How AI Is Transforming the FinTech Patent Landscape

The critical shift isn’t using AI. It demonstrates how specific technical implementations solve concrete problems that patent offices recognize as genuine innovation rather than mere automation. Patent offices want to see a technical solution that addresses a specific technical issue, going beyond basic data handling or abstract ideas.

What Patent Offices Actually Want to See

The USPTO’s July 2024 AI eligibility guidance provides an explicit framework: patenting AI algorithms, AI-based claims must recite a specific technical improvement or practical application to be eligible. The guidance emphasizes that the USPTO will take a critical stance on AI inventions that merely use generic algorithms or basic data processing without clear technical improvement.

This translates to concrete requirements. Does your AI reduce computing time? Improve prediction accuracy measurably? Enhance security through novel cryptographic approaches? Solve technical problems in distributed systems? Patent examiners need evidence, not assertions.

The Federal Circuit’s April 2025 Recentive Analytics v. Fox Corp. decision crystallized the standard: “Claims that do no more than apply established methods of machine learning to a new data environment, without disclosing improvements to the machine learning models themselves, are patent ineligible.” Simply invoking AI to automate known tasks, even sophisticated ones, fails the eligibility test.

But the pendulum may be shifting. In September 2025, USPTO Director Kathi Vidal vacated the Patent Board’s rejection of a DeepMind AI application, which the Board deemed an abstract algorithm. The invention addressed “catastrophic forgetting” in sequential machine learning training, a genuine technical challenge. The review panel found that the claims integrated the mathematical idea into a practical application that improved how a computer functions (reducing memory needs and increasing efficiency).

Director Vidal’s decision explicitly warned against “categorically treating all machine learning inventions as abstract,” noting this “risks undermining U.S. technological leadership.” She emphasized that patentability should focus on concrete benefits, such as improved computer performance. That examination should prioritize novelty and non-obviousness rather than killing applications at the eligibility stage.

This aligns with European practice. The EPO granted DeepMind’s corresponding patent after finding the training method provided a clear technical effect. The EPO examiner formulated the claim to ensure “the technical effect is clearly defined and directed to a real-world task in which the mathematical method serves a technical purpose.”

Technical Innovations That Clear the Bar

Successful AI fintech patents from 2020-2025 demonstrate patterns worth examining:

Federated Learning for Fraud Detection (Lucinity, 2024): Lucinity secured a U.S. patent for its federated learning system, enabling banks to share algorithmic insights while keeping underlying customer data private. The patented technique uses a unique architecture with two neural networks that exchange only aggregated weight updates (deltas), preserving privacy by never transmitting raw data. This required solving problems in distributed computing and homomorphic encryption, rather than merely applying federated learning generically.

FICO’s Responsible AI Portfolio (2022-2025): FICO was granted 10 new patents in 2025, covering explainable AI, bias mitigation, and fraud analytics. One patent, “Method for Real-Time Enhancement of a Predictive Algorithm by Measuring Concept Drift,” outlines a method for monitoring machine learning models in production for changes in data patterns. FICO’s patented solution detects shifts in input data distributions and dynamically adjusts the model or alerts operators, addressing the technical challenge of maintaining model accuracy as financial behavior evolves.

Another FICO patent, “False Positive Reduction in Anomaly Detection,” targets fraud detection systems by using context (e.g., repeat transactions at the same merchant) to intelligently filter out likely benign anomalies. This improves precision by enhancing the decision logic rather than adjusting business rules.

Bank of America’s Virtual Assistant “Erica”: B of A patented aspects of Erica’s natural language understanding system, including a machine-learning system that analyzes customer financial data and voice commands to generate personalized financial advice with improved accuracy over rule-based systems. The patents detail specific NLP architectures optimized for banking terminology and real-time decision engines meeting security and compliance requirements.

JPMorgan’s Trading and Cybersecurity AI: JPMorgan patented an AI-driven trading strategy system using deep reinforcement learning to adapt to market volatility. The patent detailed specific neural network architecture and training methods that improved execution performance and reduced latency in high-frequency trading. Another patent covers AI-based network intrusion detection for fintech systems, leveraging anomaly detection algorithms tailored to financial transaction networks and employing novel feature extraction from transaction flows.

These examples share common elements: specific technical architectures, measurable performance improvements, solutions to concrete computational challenges, and details enabling reproduction by skilled practitioners. They don’t just claim “AI for fraud detection”; they claim technical mechanisms that make fraud detection faster, more accurate, or more privacy-preserving.

Key Technical Categories Driving Patents

Several innovation areas generate particularly strong patent positions:

Machine Learning Model Improvements: Patents claiming improved neural network architectures for financial data, methods that handle concept drift to keep models accurate over time, and architectures for real-time processing of streaming financial data. The USPTO recognizes these as potentially patentable when they provide technical improvements, such as more efficient resource use or novel model architectures.

Federated Learning and Data Privacy: As Lucinity demonstrated, patents on federated learning systems specify how models train across multiple parties without centralizing data, including protocols for securely aggregating model updates and mitigating issues such as non-i.i.d. data or straggler clients. These address technical challenges in distributed computing and cryptography while complying with increasingly stringent data privacy laws.

Explainable AI (XAI) and Model Transparency: FICO’s patent, “Attributing Reasons to Predictive Model Scores with Local Mutual Information,” exemplifies this category. This explainable AI approach identifies which factors most contributed to fraud scores or credit decisions by computing local feature importance. Equifax has approved or submitted patents for explainable AI techniques, including neural networks, gradient-boosted machines, and random forests, indicating that credit bureaus recognize XAI as a patentable technical innovation.

Fraud Detection & Security Enhancements: Patents focus on anomaly detection algorithms tuned for financial transactions, techniques to reduce false positives, and AI systems that adapt to new fraud patterns. Some of FICO’s new patents address adversarial attack defense and identity resolution in large datasets, technical responses to evolving threats, rather than business rule adjustments.

Document and Image Processing: AI parsing of complex documents generates patents detailing technical solutions, including multimodal AI models that combine computer vision and NLP, specialized training datasets, and error-correction techniques. These solve technical image- and text-processing problems, not merely abstract data extraction, through innovations in analysis methods.

Patentability Challenges for AI in FinTech

Understanding rejection patterns helps applicants avoid common pitfalls. The USPTO’s guidance and recent court decisions establish clear boundaries between patent-eligible innovation and unpatentable abstraction.

The Abstract Idea Problem

The Supreme Court’s Alice v. CLS Bank decision (2014) continues dominating AI fintech patent examination through its two-step framework. Step one: Are claims directed to abstract ideas like intermediated settlement or fundamental economic practices? Step two: Do additional claim elements provide an “inventive concept” transforming abstract ideas into patent-eligible applications?

The Recentive decision demonstrates how courts apply this framework to AI. Patents claiming machine-learning methods for generating TV broadcast schedules were invalidated as abstract. The Federal Circuit held that “applying AI in a conventional way to a standard business problem will likely be seen as an abstract idea unless the application yields a technological improvement.”

Patent examiners now expect substantially more than “we use AI to do X.” They want to see:

Specific Technical Problems Addressed: Not “improve credit decisions” but “reduce false positive rate in fraud detection while maintaining 99.9% recall through novel ensemble architecture combining transaction velocity analysis with graph-based network anomaly detection.”

Measurable Performance Improvements: Quantitative evidence showing 40% reduction in false positives, 10x throughput increase, or 50% latency reduction compared to baseline approaches.

Novel Technical Implementations: Details of model architectures, training workflows, data pipeline innovations, or deployment schemes that solve concrete computational challenges rather than automate existing business processes.

Concrete Computer System Improvements: Evidence that the invention makes computer systems function better: faster processing, reduced resource consumption, enhanced security through novel cryptographic approaches, or improved scalability under load.

Inventorship Requirements

As of February 2024, the USPTO affirmed that an AI-assisted invention can be patented, provided that a natural person who made a significant contribution is listed as the inventor. This followed well-publicized DABUS test cases in which AI systems were denied inventorship status.

For fintech teams using generative AI tools to draft code, suggest architectures, or optimize hyperparameters, documenting human contribution becomes crucial. Teams must identify natural persons who made inventive decisions, such as:

- Choosing specific feature sets for credit scoring models.

- Designing training regimes for fraud detection systems.

- Architecting deployment schemes for real-time risk assessment.

- Selecting model architectures based on technical requirements.

Practical documentation includes laboratory notebooks that record human decision-making; version control systems (Git commit logs) that attribute inventive contributions to specific developers; experiment tracking platforms (MLflow, Weights & Biases) that document human choices in model architecture; and design review meeting minutes that capture the reasoning behind technical decisions.

European and Global Considerations

The EPO takes a different approach but arrives at similar conclusions. Under EPO guidelines, AI algorithms are mathematical methods; to be patentable, they must be integrated into a specific technical application or produce a technical effect.

An AI-implemented fintech solution must solve a technical problem (such as enhancing security or processing efficiency in a payment system) rather than merely a financial or administrative one. An AI that predicts stock prices may not be patentable in Europe (it is considered a financial method), but an AI that improves a trading system’s computational throughput or cryptographic security could be.

The Chinese patent office (CNIPA) has generally been more liberal in granting software and AI patents, as evidenced by volume. However, enforcement and patent quality vary, requiring different strategic considerations for protection versus freedom-to-operate analysis.

Strategic IP Playbook for AI-Driven FinTech Companies

Building patent portfolios requires different approaches depending on the company’s stage, resources, and competitive positioning. The following strategies reflect successful patterns from 2018-2024 patent activities.

For Startups: Building Defensible Moats Early

Early-stage fintech companies should identify 1-3 core AI technical differentiators and focus initial filings on these areas rather than attempting comprehensive coverage. Examples include:

- Proprietary data feature sets are improving credit risk prediction.

- Unique ensemble architectures enhancing fraud detection accuracy.

- Specialized latency-optimizing pipelines enabling real-time decisions.

Consider Sardine’s approach: the startup recently secured $70 million in Series C funding, partly on the strength of patented AI agents for KYC and payment screening. The patents demonstrated technical moats around specific implementations, not generic AI applications.

At Rapacke Law Group, we work with SaaS founders and fintech startups to identify which AI innovations warrant patent protection and which should remain trade secrets. Our SaaS Patent Guide 2.0 provides specific frameworks for evaluating the patentability of your AI innovations before investing in applications. Unlike traditional firms charging unpredictable hourly rates, we offer transparent fixed-fee pricing and back our work with The RLG Guarantee.

Cost-conscious strategies include:

Provisional Applications: Establish priority dates at a lower initial cost ($280 USPTO filing fee vs. $1,820 for utility applications), providing 12 months to refine inventions before non-provisional filing. This approach works particularly well for startups still validating technical implementations.

Jurisdictional Prioritization: File in key markets (U.S., Europe) rather than pursuing global coverage initially. Use Patent Cooperation Treaty (PCT) applications to defer national phase costs while preserving international filing options.

Funding Alignment: Time patent applications around funding rounds when resources are available for prosecution costs, typically $10,000-25,000 per application through issuance. At RLG, we offer transparent fixed-fee pricing so you know precisely what patent protection will cost, with no surprise hourly billing that could derail your budget.

Documentation habits that support strong applications include architecture diagrams showing data flows and system components, performance benchmarks demonstrating technical improvements, experimental logs documenting model development decisions, and customer pilot data evidencing real-world performance gains.

For Established Institutions: Portfolio Management

Large financial institutions typically prioritize breadth, building portfolios around AI risk platforms, multi-product personalization engines, and internal AI development toolchains. This provides stronger competitive moats and more valuable cross-licensing positions.

Bank of America’s 94% portfolio growth since 2022 reflects systematic invention harvesting. Cross-functional IP committees, including data science, engineering, legal, compliance, and business stakeholders, identify patentable innovations across AI projects through regular invention harvesting sessions, quarterly IP reviews, and integration with product development cycles.

Portfolio analytics help organizations understand their IP landscape by:

- Mapping patents against strategic themes (fraud detection, SME lending, wealth management).

- Identifying coverage gaps requiring additional filings.

- Revealing licensing opportunities with competitors or partners.

- Supporting competitive intelligence on rival patent activities.

JPMorgan announced in 2021 an initiative to open some patents related to low-carbon technology, demonstrating how banks strategically leverage patents to drive collaboration and ESG goals. While competitive pressures mean most fintech AI patents remain defensive, selective sharing or cross-licensing can accelerate innovation in areas such as fraud prevention, where collective action benefits all participants.

Combining Patents with Trade Secrets

Effective IP strategies layer different protection types rather than relying solely on patents. The decision framework considers:

Patent Protection Works Best For:

- High-level system architectures that competitors would likely develop independently.

- Platform technologies enabling multiple applications.

- Key algorithms providing competitive advantages.

- Compliance and governance frameworks.

Trade Secret Protection Works Best For:

- Operational procedures that competitors cannot reverse engineer.

- Proprietary datasets providing competitive advantages.

- Internal risk heuristics and business intelligence.

- Specific training methodologies and data labeling strategies.

Unique financial datasets often cannot be patented directly but provide crucial support for patent arguments about improved AI system performance. Long transaction histories, detailed customer interaction data, and comprehensive risk event records enable AI innovations competitors cannot easily replicate, even with access to the same algorithms.

Navigating Patent Office Examination

Understanding examination practices helps applicants craft stronger applications that survive scrutiny and provide meaningful protection. The USPTO’s enhanced examiner training and updated guidance set specific expectations for AI-fintech patent specifications.

What Examiners Need to See

Patent examiners now expect substantially more technical detail than previously required for software-based financial inventions. Strong AI fintech specifications should contain:

Detailed System Architectures: Clear diagrams showing data flow, model integration, and deployment infrastructure with specific technical components labeled. Not generic “AI system” boxes but specific technologies: “Apache Kafka streaming layer,” “TensorFlow Serving inference endpoints,” “Redis feature store.”

Performance Benchmarks: Quantitative results demonstrating improvements in accuracy, latency, throughput, or other measurable metrics. “40% reduction in false positive rate compared to rule-based baseline” or “sub-100ms p99 latency at 100k transactions per second.”

Implementation Specifics: Sufficient detail enabling skilled practitioners to reproduce the invention without undue experimentation. This includes model architectures (layer types, dimensions, activation functions), training procedures (loss functions, optimization algorithms, hyperparameters), and data processing pipelines.

Technical Problem Statements: Clear articulation of specific technical challenges addressed by the invention addressed by the invention. Not “improve fraud detection” but “reduce false positive rate in real-time transaction screening while maintaining sub-100ms decision latency under 10x peak load.”

Comparative Analysis: Evidence showing how the invention improves upon existing technical approaches, ideally with ablation studies demonstrating which technical elements contribute to performance gains.

The USPTO’s July 2024 AI guidance provides illustrative examples of patent-eligible AI inventions, offering applicants a roadmap for claim drafting. These examples emphasize the connection between AI innovations and concrete technical improvements in computer systems.

Common Rejection Patterns and How to Avoid Them

Analysis of AI fintech patent prosecution reveals recurring rejection patterns:

Generic AI Application: Claims applying standard machine learning to known financial data without technical improvement. Avoid by emphasizing novel architectures, improved data-handling workflows, or specific technical innovations enabling performance gains.

Abstract Business Method: Inventions automating existing financial processes without solving technical problems. Avoid by framing claims around how computer systems process financial data more efficiently, accurately, or securely.

Lack of Technical Effect: Applications failing to demonstrate concrete improvements in computer system performance. Avoid by including quantitative benchmarks, system performance metrics, and evidence of technical advantages.

Obviousness Over Prior Art: Inventions combining known AI techniques in predictable ways without unexpected results. Avoid by demonstrating non-obvious technical choices, surprising performance improvements, or solutions to previously unsolved technical challenges.

Insufficient Technical Detail: Specifications describing business outcomes but lacking implementation specifics. Avoid by including detailed architectures, training procedures, and data processing workflows, with sufficient technical detail for reproduction.

International Filing Strategies

Fintech companies with global operations must navigate overlapping but not identical rules across jurisdictions. Patent Cooperation Treaty (PCT) applications enable unified filing strategies:

Initial PCT Filing: File a single international application to establish a priority date in 150+ countries, providing 30-31 months before entering national phases.

Strategic National Phase Entry: Enter national phases in key fintech hubs (U.S., Europe, U.K., Germany, Singapore, Hong Kong, China) based on business priorities and patent budgets.

Claim Adaptation: Tailor claim language to satisfy different examination standards, emphasizing technical implementation for USPTO, technical effect for EPO, and innovation merit for CNIPA.

Portfolio Coordination: Ensure that claims across jurisdictions provide complementary protection without unnecessary overlap or gaps.

Freedom-to-operate analysis becomes increasingly complex across multiple jurisdictions. A fraud detection algorithm patented in the United States might face different prior art landscapes in Europe or China, requiring tailored prosecution strategies and potentially different claim scopes to achieve meaningful protection in each market.

Looking Ahead: The Future of AI FinTech Patents

The patent landscape will evolve as emerging technologies reshape financial services and patent offices adapt examination practices. Understanding likely trajectories helps companies prepare strategic responses.

Emerging Patent Opportunities

Several technology areas will likely generate significant patent activity over the next 5-10 years:

Generative AI Applications: Large language models fine-tuned for financial document processing, regulatory reporting automation, and customer communication. Patents will likely focus on domain-specific training approaches, prompt engineering techniques that enable reliable outputs, and integration architectures that connect LLMs to financial systems.

Agentic Systems: Multi-agent AI coordinating complex financial workflows, autonomous trading systems, and intelligent process automation. Technical innovations may include agent communication protocols, coordination mechanisms for distributed decision-making, and hybrid human-AI workflows maintaining regulatory compliance.

Privacy-Preserving AI: Federated learning across financial institutions, secure multi-party computation for risk assessment, and differential privacy for regulatory reporting. These solve genuine technical problems while meeting increasing privacy requirements, creating strong patent positions.

Quantum-Resistant Security: Post-quantum cryptographic implementations, quantum key distribution for payments, and quantum-secure transaction protocols. As quantum computing capabilities advance, early patents in quantum-resistant financial systems may become critical.

Real-Time Compliance: Automated regulatory monitoring, intelligent transaction screening, and adaptive risk management systems. Technical innovations enabling real-time compliance checking at scale while maintaining accuracy present ongoing patent opportunities.

Rising Complexity and Cross-Industry Collaboration

AI systems in finance increasingly interact with other regulated domains, including healthcare data integration, mobility and logistics networks, and e-commerce platforms. This convergence creates patent opportunities spanning multiple industries and complex inventorship arrangements.

Collaboration among traditional banks, cloud infrastructure providers, specialized AI companies, regtech firms, and non-financial platforms creates multi-party ecosystems in which intellectual property ownership and licensing become increasingly complex. Successfully navigating these arrangements requires sophisticated IP strategies accounting for different business models, regulatory constraints, and competitive dynamics.

Companies should prepare for more complex IP arrangements, including:

- Cross-licensing agreements spanning multiple technology domains.

- Standards-essential patents in digital identity and payments infrastructure.

- Consortium-run open standards for AI risk assessment and regulatory reporting APIs.

- Patent pools enable collaborative innovation while maintaining competitive positions.

The firms best positioned to capture long-term value will treat artificial intelligence, financial technology, and patents as integrated elements of a single strategic framework rather than separate operational concerns.

Your Next Steps to AI Patent Success

AI is reshaping financial services at unprecedented speed. Whether you’re developing fraud detection algorithms, building lending platforms powered by machine learning, or creating payment systems enhanced by neural networks, your technical innovations represent significant competitive advantages. But only if you protect them properly.

The bottom line: Weak patent applications waste money and leave your innovations vulnerable. Strong, technically detailed patent applications create enforceable rights that deter competitors from copying your AI implementations. The difference between the two often comes down to working with patent counsel who understands both AI technology and the specific requirements of modern patent examination.

The consequences of a poor AI patent strategy compound quickly. Competitors reverse-engineer your systems. Your valuation suffers during funding rounds when investors discover weak or missing IP protection. You lose negotiating leverage in partnerships and M&A discussions. In the U.S. first-to-file system, hesitation means someone else may patent similar implementations first, blocking your own freedom to operate.

Here’s what to do next:

- Schedule a Free IP Strategy Call with our team to evaluate the patentability of your AI innovations and develop a protection strategy aligned with your business goals and budget.

- Document your technical implementations now. Capture architecture diagrams, performance benchmarks, experimental logs, and the human decision-making behind your AI systems before memories fade and team members move on.

- Review our AI Patent Mastery resource to understand precisely what patent examiners look for in AI fintech applications and how to position your innovations for maximum protection.

- Assess your broader SaaS legal needs using our SaaS Agreement Checklist to ensure your IP strategy aligns with customer contracts, development agreements, and employment terms.

The AI fintech companies building defensible competitive advantages today are investing in strategic patent protection while their innovations are still being developed, not after competitors have already entered the market. Each month you delay, your technical implementations become more challenging to protect, and competitors move closer to launching similar systems.

At Rapacke Law Group, we specialize in protecting AI and software innovations for tech startups and fintech companies. Unlike traditional law firms that charge unpredictable hourly rates, we offer transparent fixed-fee pricing so you know exactly what patent protection will cost before you commit. Our experienced U.S. patent attorneys lead your application from initial strategy through USPTO examination, and we back our work with The RLG Guarantee. If your patent application is rejected for reasons within our control, you will receive a full refund.*

Your AI innovations deserve protection as sophisticated as the technology itself. Let’s make sure you get it.

To Your Success,

Andrew Rapacke

Managing Partner, Registered Patent Attorney

Rapacke Law Group

Connect with us: LinkedIn: Andrew Rapacke | Twitter: @rapackelaw | Instagram: @rapackelaw

*Guarantee terms and conditions apply. Full refund if USPTO denies patent application due to issues within RLG’s control during prosecution. Does not cover rejections based on prior art unknown at the time of filing or inventions that fail to meet the statutory requirements for patentability.